3 myths about financial planning and why you and your clients shouldn’t believe them

Posted onDid you know that Vikings didn’t actually wear horns on their helmets? Despite popular belief, their iconic headwear was made up by Richard Wagner for a 19th century opera. But according to the Independent, this is one of the top 10 misconceptions that Brits believe.

When you aren’t familiar with something, it can be easy to fall back on your assumptions and you can end up starting to believe all sorts of myths and legends. In our experience this is often the case when it comes to financial planning.

If your clients want to reach their life goals, working with an expert can be invaluable. So, read on to find out the truth about the three biggest myths of financial planning.

1. It doesn’t pay for itself

One of the biggest myths surrounding financial planning is that it’s only for the very wealthy and rarely pays for itself in the long term. But while this misconception is commonplace, it isn’t actually true.

The strongest argument against this myth is the ‘Revisiting the value of financial advice’ report published by the International Longevity Centre (ILC), which showed that:

- People who received financial advice were, on average, better off by £47,706 over the course of 10 years than those who had not

- Clients with an ongoing relationship with their planner had 50% more pension wealth than those who only spoke to them once.

As you can see, seeking financial advice can be very valuable in the long term. Working with a planner can help your clients to build their wealth much more effectively and reach their long-term goals.

Furthermore, the report also noted that the financial benefits of advice were greater for people of modest means, rather than those who were already wealthy. This finding helps to dispel the myth that planning is only for the affluent.

2. You only need a plan in the run-up to retirement

Another common misconception about financial planning is that it’s only really useful when you’re approaching retirement. This is somewhat understandable, as many people seek help when preparing for this important stage of the life, but it isn’t true.

One of the biggest benefits of working with a financial planner is that they can help your clients to manage their money more effectively. As you might imagine, this can be valuable no matter what stage of life they’re at.

For example, if your clients are investing their wealth to save up to buy a home, a planner can act as a useful sounding board to help grow their portfolio more effectively.

Alternatively, working with an expert can be useful when getting married. Professional advice can enable your clients to manage their assets in a more tax-efficient way, helping them to save more of their hard-earned money.

Of course, financial planning can also be especially useful when preparing for retirement, but a long-term approach can be much more useful than trying to sort things at the last minute. The earlier clients start saving, the better!

If you were throwing a party, you wouldn’t wait until the night before to buy supplies and invite the guests. Instead, you’d know that preparing ahead of time can make the event go much more smoothly, and the same is true for financial planning.

Seeking professional advice before retirement can give your clients more time to grow their wealth, so they can enjoy this chapter of their lives to the fullest.

3. Planners only offer financial support

The third myth that many people believe is that when you work with a planner, they only offer financial support. Of course, while seeking professional advice can greatly boost your clients’ wealth, this isn’t the only benefit they can receive.

Working with a planner can have mental health benefits too, such as by reducing stress, as finances can often be a common cause of concern. According to a recent study published in Money Marketing, almost two in five Brits worry about money.

A financial planner can help to put your clients’ minds at ease by being on hand to answer any questions they might have about their finances, as well as offering comfort and reassurance.

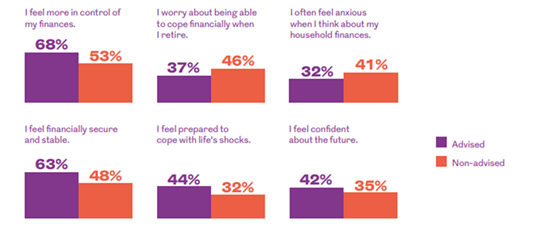

This is reinforced by a Royal London report, which showed that working with an expert can improve mental wellbeing. Clients who received advice felt more confident and in control of their finances, as well as being more confident about their future.

Source: Royal London

Having a trusted partner in their corner gives your clients valuable reassurance that their future is in safe hands.

Get in touch

If you have clients who you think may benefit from working with a financial planner, we can help. Email enquiries@blackswanfp.co.uk or contact us on 020 3828 8100.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

Production

Production