3 positive reasons to diversify your investments (or why you don’t want all of your eggs in one basket)

Posted onIt’s been an uncertain few months in the global economy. A post-Covid boom in demand, coupled with the war in Ukraine, has seen prices for things like energy, food, and fuel rise sharply.

To combat soaring inflation, central banks have raised interest rates which, in turn, means we are seeing slower growth and the possibility of a recession.

All this has had an impact on the price of assets, most notably equities (stocks and shares). Indeed, JP Morgan report that it was the worst first half of the year for developed market equities in over 50 years.

When times are tough, remembering some key investment philosophies can help you to weather the storm. Staying patient and focusing on the long term are often sensible decisions – and one of the other key ways to ride out volatility is by ensuring you have a well-diversified portfolio.

Read on to find out more about diversification, and for three benefits of not putting all your eggs in one basket.

Diversification aims to spread risk across asset classes

In simple terms, a well-diversified portfolio aims to reduce the volatility of your assets.

Here’s an example. If you invested all your cash in one single company, and its share value fell by 10%, you’d experience a sharp loss. This carries a high level of risk as only one bit of bad news – lower than expected profits, regulatory changes, or a change in trends – can cause the price to fall.

However, if you invested your cash across 100 companies, a fall in the value of one share can often be offset by a rise elsewhere. This can significantly improve your chances of increasing the value of your investments over time.

When it comes to diversification, your “asset allocation” – how you spread your cash across various asset classes – is an important factor in determining your return. Broadly, there are four asset classes:

- Equities – you invest in the shares of a company. Shares are considered high-risk as values can fall as well as rise.

- Bonds – you make a loan to a government or corporate entity, which is repaid to you with interest. Bonds are usually considered low-risk.

- Cash – such as cash savings. These are low-risk but inflation can see the real value of your savings diminish over time.

- Property – either through a fund or by buying a property. Property is typically seen as higher-risk as prices fluctuate, plus it’s harder to liquidise your investment when you need the funds.

The right asset allocation for you will depend on a wide range of factors, such as what you are investing for, your timescale, and how much risk you are prepared to take.

Our role as your financial planner is to work with you to create an asset allocation that suits your goals, objectives, and tolerance for risk.

3 benefits of diversifying your investments

Here are three key benefits of spreading your investments across asset classes.

- Increases your chances of gaining positive returns

If you rely too heavily on just one asset class, a fall in the value of those assets could have a substantial impact on your wealth. While strong performance could result in significant returns, poor performance could equally result in large losses.

Diversifying means you manage risks but also increase the possibility of rewards. By not being too reliant on only one asset class, region, or sector, you can improve your chances of seeing a return on your investments.

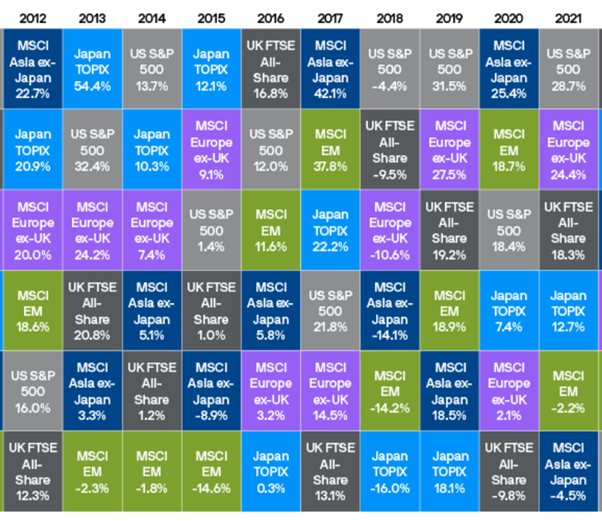

Here’s an example. The table below shows the annual return of shares in regions across the world between 2012 and 2021. The chart shows the annual performance of stock indices in the US, UK, Japan, Europe, emerging markets, and Asia.

Source: JP Morgan

Let’s take 2020 as an example. Had you invested all your money in the UK stock market, you’d have seen the value of your portfolio fall by almost 10%.

However, had you spread your wealth across geographical areas – so you held shares in Asia, the US, Europe and so on – the gains made by stock markets in these regions would likely have offset the losses made in the UK.

Indeed, shares in the Asia ex-Japan index rose by more than 25% in 2020 alone.

- Avoids “home bias”

When it comes to investing, it’s easy to believe you should “invest in what you know”. That might mean you’re tempted towards “home bias” – investing in shares in the country or region where you live because you recognise the names of companies or buy their products or services.

However, according to Statista, the UK only represents around 4% of the global equity market. So, if you hold more than 4% of your wealth in UK shares, you’re effectively “overweighted” in UK investments.

Since diversification considers both different asset classes and a geographical spread, it can help you to grow your wealth more effectively by seeking investment opportunities across the globe.

- Helps you to consolidate gains

As you approach your investment goal, you might be keen to consolidate the gains you have made.

Diversification allows you to do this by easily rebalancing your portfolio. This means increasing the amount of lower-risk assets you hold and, helping to ensure that your money’s value doesn’t drop suddenly at the point that you need it most.

Without diversification, it is harder to change the balance of your portfolio to lock in these gains.

Get in touch

Diversification is a great way to manage risk and reward – especially in uncertain times.

To find out how we can help you build a well-diversified portfolio, email us at enquiries@blackswanfp.co.uk or contact your adviser on 020 3828 8100.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

Production

Production