36 million Brits targeted by a scam in 2021 – why you need to remain vigilant

Posted onWith more than two-thirds of adults in the UK targeted by various scams this year alone, it has never been more important to stay on your guard.

New research conducted by Citizens Advice shows that the number of reported scams in 2021 so far has more than doubled compared to the same period in 2020.

Because you will have spent more time at home over the last year, it will perhaps come as no surprise that national internet usage has soared. Thanks to our internet-dominated lives, you are now more at risk of encountering an online fraudster.

Naturally, the evolution of technology results in more sophisticated scams, and the introduction of new investment opportunities and cryptocurrencies allows for a greater range of scam types.

It can be daunting to think of everything you need to look out for when protecting your money, so read on for some useful tips on how to spot and avoid common scams.

3 common types of scam to look out for

Scams can come in all shapes and sizes. From a friend’s hacked social media account to an official-looking email from “Halifax”, it can be hard to know what’s legitimate and what isn’t.

Whether you’re looking to invest, or entering some personal details into an online form, always double check that the offer or webpage is from a trusted source. Here are some of the most frequent scams to be aware of.

1. Investment scams

Often advertising unmissable opportunities to generate high returns, social media-based investment scams reported by Action Fraud have claimed a total of more than £63 million between April 2020 and March 2021.

There are a variety of methods that investment scammers may use to lure you in, so be sure to do your research when contemplating whether to hand over your money.

Some of the tactics a criminal may use include:

- Fake celebrity endorsements

- Rushing you to make a payment for a limited time deal

- Contacting you randomly through a cold-call or email

- Promising you that this opportunity is only for you and not to tell anyone else.

Some fraudsters even produce investment brochures and legitimate looking websites to convince you that they are genuine. As Sanjay Andersen from the City of London Police’s National Fraud Intelligence Bureau says: “Visit the FCA’s website and check and double check every detail before handing over your money or personal details.”

2. Pension scams

Pension scams are just as common and often target older and more vulnerable people.

The lure of free pension reviews and limited time, high return deals can lead unsuspecting victims to lose their entire life savings in an instant. One of the most common types of pension scam is the promise of an early pension release, offering to help you withdraw money from your pension before the age of 55.

Not only could this money end up in an account that isn’t yours, or charge you a high percentage of your pension as “payment”, but you could also face high fees from HMRC.

From January to March 2021, Action Fraud reports that there was a 45% increase in pension scams from the same period last year, resulting in total losses of £1.8 million. Keep your eye out for similar tactics to those used in investment scams with added keywords such as “loophole” and “cashback.”

3. Phishing scams

You would be hard pressed to find someone with a mobile phone who hasn’t recently received the classic “parcel delivery” text.

Usually claiming to be part of a well-known courier service, such as Royal Mail or DPD, a scammer will send out a text that will ask you to either track your parcel by entering personal details or pay a small settlement fee. This is an example of “phishing”.

Phishing is one of the most varied and long-running types of scam. It can range from phone calls to emails and anything in-between, so it’s hard to know at a glance whether what you’re dealing with is legitimate or not.

Usually, the goal of a phishing scam is to trick you into giving over personal details such as a password or bank account, or to forward you to a webpage that can automatically download malicious software onto your laptop or PC.

Phishing is constantly evolving. Every effort will be put into these fake communications to make them appear real. Even as recently as January this year, an email that looked as though it was from the NHS was sent across the country promising a Covid vaccine if recipients entered their bank details.

This email was reported to Action Fraud more than 1,000 times in a 24-hour period. This is why it is always vital to check the legitimacy of any contact made by a business or individual before giving any important information.

A newer scam you should be aware of

Investing in cryptocurrency has become a popular trend over the last few years, with a single bitcoin currently worth more than £22,000.

Success stories can be found all over the internet from those who made millions from a small investment back in 2009 or the early 2010s. According to the Guardian, an estimated 2.3 million Britons own a form of cryptocurrency, a total of around 4.4% of the adult population. Such a drastic explosion in popularity has given rise to new methods for scammers.

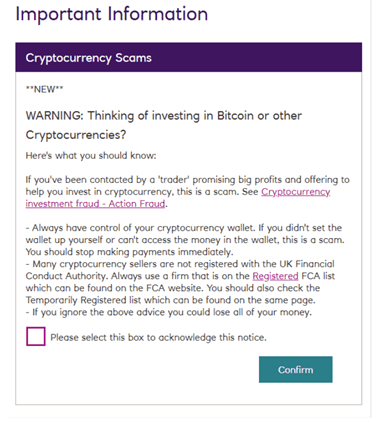

Nearly half of investment scams (44.7%) over a recent 12-month period have been reported to be advertising some form of cryptocurrency. It has reached such an unprecedented level that some banks, like NatWest below, have posted warnings on their own website about the unique dangers of this type of fraud.

If you receive an offer to invest in cryptocurrency, make sure to think twice and always check that the trader is legitimate.

How we can help

As financial planners, one of our roles is to help you avoid these types of scam. If you receive an offer for an investment opportunity, early pension release, or any of the circumstances mentioned above, come to us first. We can help identify whether the deal is genuine and help you to avoid being defrauded.

Talking to, and following the advice of, an expert is key in keeping your wealth safe and secure. Recently, a client of ours fell victim to a bitcoin investment scam, which we had warned them not to consider. As financial specialists, we know what to look out for when recognising a scam, and we can help to keep you safe.

Get in touch

If you want to explore how we can help you in this uncertain time, please get in touch. Email enquiries@blackswanfp.co.uk or contact your adviser on 020 3828 8100.

Production

Production