5 key takeaways from the 2021 Great British Retirement Survey

Posted onPublished annually, the interactive investor Great British Retirement Survey always gives an excellent insight into changing attitudes toward retirement.

It’s also comprehensive and detailed. This year’s survey is 55 pages long and is based on feedback from more than 10,000 respondents.

As the very first line of the survey says: “A pension is likely to be the biggest pot of money someone ever has in their lifetime.” It’s the money you’ll live on after you stop work and could have to last 20 years or more.

Attitudes and opinions reflected in surveys such as this do matter. The government and the wider financial services industry can tailor legislation and products, respectively, to meet your needs and expectations.

For example, while the introduction of Pension Freedoms in 2015 was partly an expression of government ethos around giving you the power to manage your own retirement, it also reflected changing needs and priorities in terms of the way people thought about later life.

Here are five key takeaways from this year’s survey.

1. There is increasing concern about pension complexity

Changing working patterns mean it’s likely that you’ll have more than one pension pot.

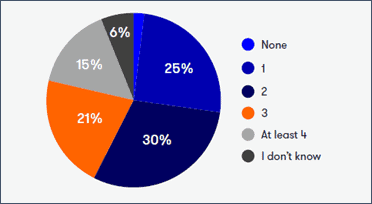

The chart below shows that, if this is the case, you’re certainly not alone. 2 in 3 people now have two or more pension funds.

In fact, recent research showed that the average person now has up to 12 jobs in their working life, with potentially the equivalent number of pension pots.

This type of scenario can create confusion, with people unsure about exactly what they have. You recently read about why it’s so important to keep control of your old pensions and trace any you might have lost track of.

And it’s not just pensions.

You may well also have ISA savings, as well as buy-to-let property and other investments. These can add further layers of complexity – especially around issues such as income planning and taxation.

2. There’s a flipside to Pension Freedoms

The introduction of Pension Freedoms in 2015 gave you unprecedented control over what you can do with your pension fund. One knock-on effect of this has been the rise in the number of people researching pensions and investment options.

Two-thirds of respondents (64% of retired, 67% of non-retired) said they did their own research online – almost doubling last year’s figures.

There’s also recognition that there needs to be an increase in financial education given in schools. While there are no actual statistics quoted to support this, several ad hoc comments referenced it.

“Awareness of pension management should be taught at school…”

“Children at school should be taught financial planning and made aware of various tools to understand how the stock market has a bearing on savings in pensions and ISAs.”

3. Many people fear future policy changes will impact their retirement planning

The Lifetime Allowance (LTA) is the amount of pension savings you can accrue in a tax-advantaged way. If you go over the LTA, you’ll pay a tax charge that could be as much as 55%.

In 2011/12, the LTA was £1,800,000. It’s now more than 40% lower than that – currently £1,073,100 (tax year 2021/22).

Figures from the survey reflect concerns people have about this:

- 1 in 5 think they’ll breach the LTA

- 36% fear they might breach it in the future

- 34% estimate the final value of their pension will be more than £700,000 and they could potentially be impacted by any reduction in the LTA.

There is also concern about the impact of the Covid pandemic on the UK economy, and how retirement planning could be impacted by changes to the taxation of buy-to-let income.

4. Younger people have concerns over the future of the State Pension

Also, on the theme of legislation, there are concerns over the future of the State Pension. Many young people are not confident that the State Pension will exist for them by the time they retire.

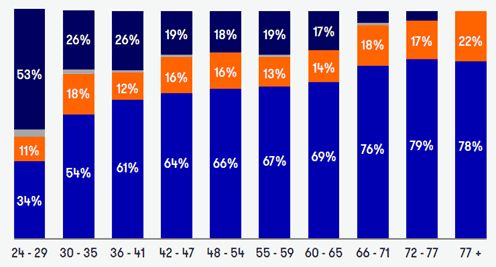

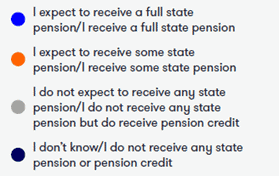

This chart shows the expectations people of different age groups have when it comes to their State Pension.

Only a third (34%) of people aged between 24 and 29 are expecting to receive a full State Pension.

Even as it stands, the State Pension is probably not enough to live comfortably on. However, it’s guaranteed for life and can be seen as a handy financial underpin to other sources of retirement income.

The fact that so many people have concerns demonstrates the importance of building a suitable sized retirement pot so that the State Pension is a bonus rather than a necessity.

5. Pension investors are less risk-averse than many appreciated

One of the big changes brought about by Pension Freedoms has been the increase in awareness of the importance of investment growth to help build your pension fund.

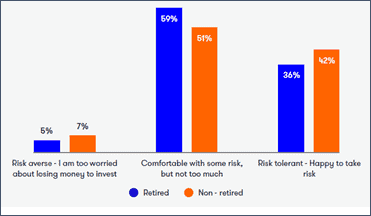

There are clear signs in the survey that people are becoming less risk-averse. A remarkably low percentage of people – just 5% (retired) and 7% (not retired) – don’t invest because of the fear of losing money.

30% of retired people surveyed said they wished they had understood more about investment risk at an earlier stage in life. The rate was higher for non-retired respondents, with 39% saying they wished they had known more about investment risk and the benefits of taking some risk when they were younger.

Additionally, despite economic uncertainty, more than 70% said the pandemic had not changed their risk attitude.

Inflation is a growing threat, reducing the value of cash savings in real terms. The survey does demonstrate that many people are recognising the importance of a robust investment strategy to act as a counterweight to this.

Get in touch

If you think you will be affected by any of the issues raised in the Great British Retirement Survey, please get in touch.

You can email us at enquiries@blackswanfp.co.uk or contact your adviser on 020 3828 8100.

Please note

Source for all charts and figures – ii Great British Retirement Survey, 2021

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future results.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts.

Production

Production