5 scary financial mistakes to avoid this Halloween

Posted onAccording to The Grocer, Brits spent an eye-watering £431 million on Halloween in 2019. From costumes to pumpkins, the spooky season has become big business, with chocolate and sweet sales alone topping £59 million during last year’s celebrations.

While Halloween might look different in 2020 – social distanced trick or treating? – it’s still a fun season for adults and children alike. So, while the youngsters are evading ghosts and ghouls, here are five scary financial mistakes you should be trying to avoid this 31st October.

1. Keeping too much of your money in cash

In turbulent times, people often retreat to the ‘safe haven’ of holding their assets in cash. While it may mean there is little to no risk to your capital, there is a strong chance that inflation will erode the value of your savings.

A recent report from financial analysts Moneyfacts found that, between March and September 2020, the average easy access savings rate in the UK fell from 0.57% to 0.23%. That’s an annual return of just £115 for a £100,000 investment. Since inflation is currently low, it’s unlikely that your return from cash will keep pace with rises in the cost of living.

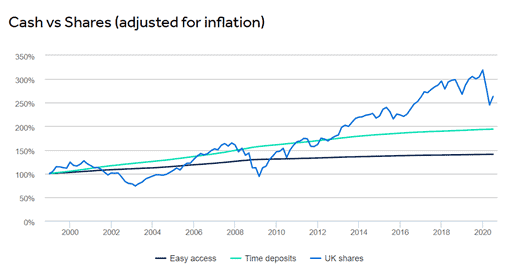

Here’s some data from the last 20 years that compares the returns from cash, time deposits, and shares.

Source: HL

Since January 1999, returns for savers in the average easy access account have failed to keep up with inflation. Fixed-term savings accounts have fared better as, between January 1999 and June 2020, £100 grew to £194, or £128 after inflation.

In contrast, over the same period, the stock market turned £100 into £432 before costs. This works out to £284 after inflation. This is despite some volatile periods, including the 2008 global financial crisis.

If you’re prepared to invest for the medium or long term, stocks and shares could help you avoid the scary prospect of your money not growing in line with inflation. It could give you a better chance of outperforming inflation and meeting your financial goals.

Remember that the value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

2. Not maximising your pension contributions

Pensions are one of the best ways to save for your future. The most immediate benefit is that the tax relief gives you an instant boost to your investment. As a basic rate taxpayer:

- £1,000 invested into a pension costs you £800

- £1,000 invested into an ISA costs you £1,000

If you’re a higher or additional rate taxpayer then the tax benefits are even more pronounced.

A recent study by Scottish Widows also suggests that if you were to consider your pension as an ‘investment’, you might be tempted to save even more.

Maximising the amount that you invest can help you to achieve the lifestyle you want later in life. Your future self will thank you!

3. Having insufficient protection

In recent months, we’ve all been affected by upsetting and moving stories about families losing loved ones, and individuals struggling with long-term ill-health. The news may have led you to think about your own circumstances, and how those nearest to you would cope if something happened to you.

Putting the right protection in place gives you the peace of mind that your loved ones will be provided for if the worst happens. From a tax-free lump sum if you’re diagnosed with a serious illness, to setting up a Power of Attorney so a trusted person can manage your affairs if you can’t, it’s vital you make plans.

We’ve previously looked at how giving up a couple of lattes a week could buy you more than £50,500 of life or Critical Illness cover. Now is a great time to review your arrangements.

4. Taking too much from your pension

In the modern world, it’s likely that your pension may have to last you 20, 30 or even 40 years. As life expectancy increases, and flexible retirement becomes more popular, it’s never been more important to regularly review your finances to ensure you don’t run out of money later in life.

One of the most common reasons for retirees to run out of cash is that they withdraw too much from their pension in the early years.

Recently, research from pensions consultancy LCP has found that retirees who follow the ‘golden rule’ of withdrawing 4% from their pension pot each year are three times more likely to run out of money early than they were ten years ago.

The rule of 4% is ‘broken’ and ‘outdated’ in today’s low-interest-rate world, says the study, with author Dan Mikulskis claiming that ‘3% is the new 4%’.

Managing your withdrawals is critical if you want to ensure your income remains sustainable in later life – and taking advice at this stage can also help.

Research from Moneyfacts has found non-advised drawdown clients are three times more likely to run out of money compared to advised clients. This brings us to…

5. Going it alone

One of the scariest mistakes you can make with your money is to manage it without professional help. There are countless reasons that working with a financial planner can add genuine value:

- It can give you peace of mind, make you more confident, and can make you feel more in control. Read more about a recent study which demonstrates this

- Research carried out by the International Longevity Centre in 2017, and subsequently updated in 2019, has suggested that the value of financial advice could equate to £47,000 in additional wealth over the course of a decade

- Research from VouchedFor in 2020 found advised investors generate 27% higher returns over 12 months compared to those that choose to take a DIY approach.

Get in touch

If you’d like to get your finances in order, working with a financial planner can add tangible value.

Find out what we can do for you. Email enquiries@blackswanfp.co.uk or contact your adviser on 020 3828 8100.

Please note

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits. The tax implications of pension withdrawals will be based on your individual circumstances, tax legislation and regulation which are subject to change in the future.

Production

Production