5 ways personal finance has changed during the Queen’s 70 years on the throne

Posted onThis week, the country has been honouring the Queen as she becomes the first British monarch to celebrate a Platinum Jubilee.

Having ascended to the throne after the unexpected and premature death of her father, King George VI, the Queen has given her life in service of the UK and the Commonwealth.

Her Majesty has attended thousands of official engagements, made 200 trips and visits to Commonwealth and UK Overseas Territories, and “kissed hands” with 15 prime ministers.

Over her 70-year reign, there’s also been great social and political change. So, here’s a look at how money and finance has evolved since 1952.

1. The cost of goods and services has (unsurprisingly) risen

While many things have changed immeasurably during the Queen’s reign, this quote from MP Manny Shinwell, taken from Hansard in June 1952, shows that some things just stay the same.

“Our immediate purpose is to extract from the government some idea of what is their solution of the problem of living costs. I make no apology for asking questions on the cost of living and the rise in food prices.”

According to the Bank of England’s inflation calculator, if you’d bought £10 of goods and services in 1952, by 2021 they would have cost you £202.30. This is thanks to average annual inflation of 4.5% during that period.

A pint of beer cost 9p in 1952, rising to £4.08 on average now. Meanwhile, a pint of milk that would have cost 4p when the Queen ascended to the throne would cost you around 70p today.

Back in the 1950s, it was possible to enjoy a night out with a 10-shilling note (the pre-decimal half of £1). However, 10 shillings in 1952 is equivalent, in real terms, to about 2.5p now – and even the most prudent would struggle for a night out with that in their pocket.

2. Property prices have boomed

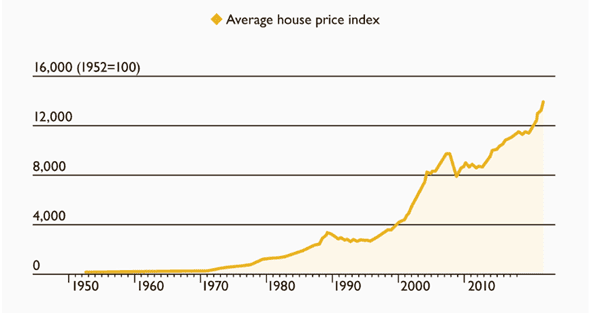

Happily, the Nationwide Building Society’s house price index dates back to 1952. Then, the average UK house price was just £1,891.

Now, the Times reports that the latest average for the Nationwide index, £260,771, is 139 times the 1952 level. This outstrips other prices and whichever measure of the growth in wages and salaries you choose to use.

Source: the Times

You’ll see that prices rose very gradually right up until the Queen’s Silver Jubilee and began to really accelerate during the housing boom of the 2000s.

Of course, Her Majesty has also benefited from this. According to Bloomberg, the value of Buckingham Palace is now a cool £1.3 billion – up £100 million since before the pandemic.

3. The move to a decimal currency

Arguably the most substantial change to personal finances during the Queen’s reign has been the change to the currency itself.

For the first couple of decades of the Queen’s reign, there were 12 pennies to the shilling and 20 shillings to the pound. There were guineas, half crowns, threepenny bits, sixpences, and florins.

Following the 1963 report by the Committee of the Inquiry on Decimal Currency, and the Decimal Currency Act in May 1969, the UK converted to its new decimal currency on Monday 15 February 1971 – “Decimal Day”.

The first decimal coins were issued in 1968, to give everyone a chance to get used to them before the old system was scrapped. A two-year public information campaign also prepared the nation for the switch, including currency converters and even a song by popular crooner Max Bygraves.

4. We pay for goods and services differently

Back in 1952, you paid for goods and services in notes and coins. By 2020, however, the Bank of England (BoE) say that just 17% of all payments were made in cash.

Paying in cash became easier in 1967 with the launch of the UK’s first cash machine (here’s a fact – the first-ever cash machine withdrawal in the world was made by On the Buses actor, Reg Varney).

Cheques grew in popularity throughout the 1980s and usage peaked in 1990, when Brits wrote 4 million of them.

Barclays issued the UK’s first credit card in 1966 and the first UK debit card in 1987. Nationwide Building Society introduced the first-ever internet banking service in 1997, and this was followed by “chip-and-PIN” payments in 2003 and contactless cards in 2007 (the contactless limit was just £10).

5. The Queen’s face on banknotes has changed

Until 1956, when the UK Treasury gave permission to the BoE to use the Queen’s portrait in a new series of notes, any bank notes in the UK had not generally featured a monarch.

The first BoE note to feature the Queen’s portrait was the £1 note issued in 1960. The 10-shilling note followed in 1961.

Robert Austin’s initial design for the notes was criticised for being a severe and unrealistic likeness. By the time the £5 was issued in 1963 and the £10 in 1964, the notes featured a new portrait by Reynolds Stone.

Fast forward to the 1970s and the notes featured two different portraits of the Queen. One version was used for £1 and £5 notes, and another for the “high sum” notes of £10, £20, and £50. This new series of banknotes was also the first to feature historical characters on the back.

The 1990 £5 note was the first of a new series, designed by Roger Withington. It featured a new, more mature portrait of the Queen who was 64 when it was first issued and has been used on all BoE notes since.

Get in touch

We’d like to pass on our best wishes to Her Majesty on the occasion of her Platinum Jubilee.

If you need us, you can email us at enquiries@blackswanfp.co.uk or contact your adviser on 020 3828 8100.

Production

Production