Can money buy happiness? It’s the freedom to reach goals that adds value to your life

Posted onIs the common saying “money can’t buy happiness” true? Research suggests that it isn’t, and that the opportunities financial security brings can deliver happiness and improve wellbeing.

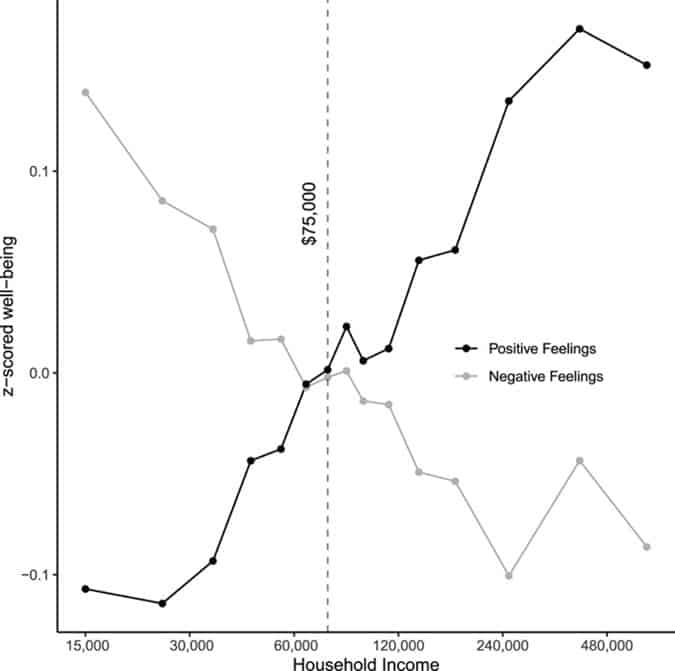

This latest study refutes often cited research, which claims money could buy happiness but only up to a point. A 2010 paper written by psychologist Daniel Kahneman and economist Angus Deaton found happiness and income were only linked up to $75,000 per year. Up to this point, life satisfaction increased in line with income, but plateaued once earnings exceeded $75,000. The paper concluded that: yes, money can improve satisfaction, but it can’t improve emotional wellbeing.

Now, however, a newly published paper is disputing this.

New research finds money can buy happiness

While the 2010 paper utilised surveys, the new one uses data collected from an iPhone app called “Track Your Happiness”. At random intervals, the app will ask users about their activities and feelings. App developer Matthew Killingsworth has based research on these findings, which are now published in the Proceedings of the National Academy of Sciences.

The title “Experienced wellbeing rises with income, even above $75,000 per year” sums up the findings.

The paper states: “Higher incomes may still have potential to improve people’s day-to-day wellbeing, rather than having already reached a plateau for many people in wealthy countries. […] There is no evidence of an income threshold at which experienced and evaluative wellbeing diverged, suggesting that higher incomes are associated with both feeling better day-to-day and being more satisfied with life overall.”

In fact, while there is a slight dip in both experienced wellbeing and life satisfaction around $100,000, there is a general upwards trend, even as annual income reaches $500,000 per year, the first figure shows. The second figure highlights that as positive feelings rise, so, too, negative feelings fall in line with income.

Source: Proceedings of the National Academy of Sciences

So, if money does buy happiness, should you focus on increasing your income and the amount in the bank?

Value of assets vs value to your life

One of the things both research papers don’t examine is why wellbeing increases as income rises.

You may get some satisfaction from watching the balance of your savings account rise, but it’s often not the number itself that improves wellbeing. Rather, it’s the security and stability it provides. Knowing that you have a safety net to fall back on, for example, can deliver a huge boost to how confident you are about the future and allow you to enjoy the present.

A rise in income can allow you to devote more of your disposable income to the things you enjoy and help you take steps towards long-term goals. However, if you need to spend more time commuting and sitting in traffic every day, so you don’t have the freedom to enjoy the additional income, would it still improve your day-to-day happiness? Some may find they feel less satisfied with life despite having more money.

While the research provides an interesting insight, focusing on what’s important to you and how your income can help you achieve this is just as important, on an individual level, as your salary.

An increase in wellbeing doesn’t have to be tied directly to your income. A five-figure sum in savings and investments can help you prepare for unexpected life events, but that doesn’t mean you can’t achieve the same sense of security without this. A financial protection product, such as life insurance or income protection, that aligns with your priorities may deliver the same sense of wellbeing.

The process of financial planning helps you understand what your goals and concerns are, and then creates a long-term financial plan that addresses them. It’s about making your assets and income work in a way that reflects your priorities, whether that’s spending more time with family, exploring the world, or taking early retirement.

Rather than solely looking at the value of your assets, looking at how they can add value to your life can help you get the most out of them.

Please get in touch if you’d like to speak to a financial planner about how you can use assets to improve your quality of life.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Production

Production