Rent is now “cheaper” than a mortgage but there are still reasons to get on the property ladder

Posted onHouse prices have soared over the last year and it means that renting a property is now “cheaper” than making mortgage repayments. Yet, while monthly costs could be higher for aspiring homeowners, there are still reasons to get on the property ladder now.

For the last six years, it’s been cheaper to pay a mortgage each month than it has to pay rent. According to the BBC, before the pandemic, people buying a house with a 10% deposit were £102 better off than renters each month. Now, tenants are better off by around £71. The reversal comes despite a 7.1% rise in average rents over the last 12 months, demonstrating just how much house prices have increased.

It’s suggested that among the reasons for this are:

- Rental demand dropping when the pandemic led to young adults returning to live with families

- City living becoming less attractive.

While the figures suggest renting is cheaper now, with a long-term view, buying a property is likely to make more sense financially if you can.

4 reasons aspiring homeowners should still consider buying a property

Buying a home isn’t the right decision for everyone or now may not be the right time. However, if you’re thinking about delaying plans simply because renting is now cheaper, there are reasons to still take the plunge and purchase a home.

1. In the long term, buying can save you money

While a mortgage could mean you end up paying more out now, if you keep up with mortgage repayments, you’ll eventually own the property and repayments can stop. In contrast, if you opted not to buy a home, you’d have to keep making rental payments indefinitely. So, if you take a long-term view, buying a home can be cheaper.

2. Your mortgage costs could reduce over time

As you build up more equity within your home, the interest rates you’re offered are likely to be more competitive. As a result, your regular repayments may fall over the years. While this isn’t guaranteed, homeowners often find their mortgage repayments become more manageable as they near the end of the term.

3. Properties are likely to increase in value

You can also view buying a property as an investment. House prices have experienced dips in the past, but historically they have risen. According to the Halifax House Price Index, house prices have increased by 9.5% in the last year alone. That’s the equivalent of £22,000.

4. It’s a chance to put your stamp on your home

When you’re renting, you may have restrictions on what you can do, such as decorating, and you don’t want to invest in the property by buying a new kitchen if it’s not yours. With your own property, you’re free to put your stamp on it and really turn it into your home. It also means you can invest in the property to make it suitable for your long-term needs and potentially increase the value too.

How can you reduce your mortgage costs?

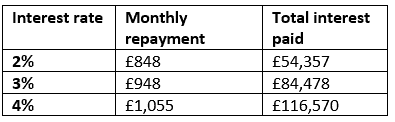

With the cost of a mortgage rising, it’s more important than ever to find a mortgage deal that’s right for you. Securing a deal that has a competitive interest rate could mean your monthly repayments are lower and you could save thousands of pounds in the long term. Interest rates are low but even a small difference can have an impact.

The table below highlights how your monthly repayments and total interest would change depending on the interest rate if you borrowed £200,000 over 25 years to buy a home.

Source: Money Saving Expert

Taking the time to search the market for a competitive mortgage deal could save you money. While some lenders have a high street presence, many don’t. It can also be time-consuming to search, as well as complicated if you’re trying to understand if your application will be accepted. This is where a mortgage broker can help you.

A mortgage broker can also help you find a deal that matches your needs. For instance, a mortgage that doesn’t require upfront fees or allows you to overpay to be mortgage-free sooner.

If you’d like to discuss buying a home and securing a mortgage, please contact us.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Production

Production