What’s likely to happen to house prices in 2022?

Posted onPredicting what might happen in the future is notoriously tricky. After all, in late 2019, who could have predicted the pandemic, with all the associated economic turmoil and general social upheaval that we’ve had over the past 21 months?

When it comes to house prices, it can be doubly difficult. For example, while many experts forecast a pandemic-related slump in the property market in early 2020, house sales and prices have been buoyant for 18 months.

What we can do is look at some of the key economic indicators and other possible events in 2022. These could give us a decent idea of what might happen to property prices in the coming 12 months.

Recent property price history

Let’s start with some historical context for you.

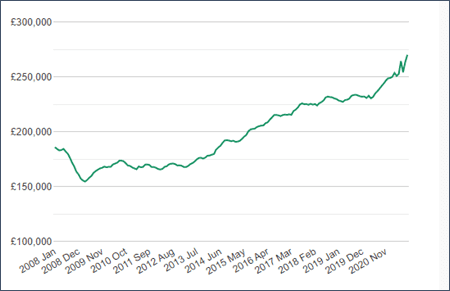

The chart below shows national average property prices since January 2008. After an initial slump in the wake of the global financial crisis, the average value has risen steadily, from £154,475 in March 2009 to £269,945 in November 2021. That’s an increase of 75%.

Source – Property Data

As part of that long-term trend, property prices since November 2020 have gone up nationally by 9.2%.

Within that figure, it’s important to note the regional variations.

In London the rise was around 4% whereas, in the north-west, property prices increased by 16%.

What drives house prices?

When it comes to predicting future house prices, it’s important to be aware of what drives increases (and decreases) in property values.

The biggest factor is the same that affects the price of nearly everything – supply and demand.

If demand is high, sellers hold all the cards. They can push prices up, knowing that there’s a market there and that people will be prepared to pay more than they may well have planned or expected.

If, on the other hand, demand is low, it’s buyers who have the advantage. They can afford to make reduced offers, knowing there’s a good chance that they will be accepted by people keen to sell.

Two big factors drove the increase in 2021

Two big factors boosted demand in 2021, and therefore contributed to the big increase in property values.

- The end of lockdown meant some suppressed demand was injected into the housing market. A big cohort of people who had planned to move in 2020 were now able to do so a year later.

- Temporary changes to Stamp Duty, announced by the chancellor in July 2020, continued into 2021 and were extended beyond their original April 2021 deadline to September.

Property industry observers, Property Eye, have already suggested that sales activity towards the end of 2021 has been “minimal” as the Stamp Duty changes came to an end.

We can therefore say that, unless there is further government intervention in the housing market next year, property prices are unlikely to increase at anywhere near the same rate as they did in 2021.

The head of residential research at leading estate agent, Savills, is anticipating a 2022 national average increase of just 3.2%, saying: “After such intensity in the market and without the imperative of a Stamp Duty holiday, we know that there’ll be less urgency in the market from 2022.”

Expected interest rate rises could dampen the market even further

This chart, showing the long-term Bank of England base rate, demonstrates how stable rates have been since they were cut from over 5% at the time of the financial crisis to below 1%.

Source: Tradingeconomics.com

Low interest rates, and therefore low borrowing costs, have increased demand and helped fuel the price rises you saw in the first chart.

Over that period, we’ve also enjoyed a period of low inflation. But this could now be coming to an abrupt end as the Office for National Statistics (ONS) have recently confirmed that the UK Consumer Price Index (CPI) inflation rate had reached 4.2% – the highest rate for 10 years.

On top of that, financial analysts at the Bank of England (BOE) have predicted that inflation will break through the 5% barrier, for the first time in 30 years, in 2022.

All this makes it likely that the BOE will increase interest rates in 2022, in a bid to drive inflation back down to their target figure of 2%.

As yet we’re not sure when, or by how much, interest rates will rise. However, it’s very likely they could have an impact on demand as the cost of mortgage borrowing goes up.

One positive sign is that mortgage lenders now stress-test the ability of borrowers to meet repayments should rates rise. This should help avoid the scenario of widespread repossessions that was previously seen when interest rates rose, particularly in the 1990s.

Working from home could drive housing market activity

One factor often overlooked when it comes to the housing market is how the pandemic has changed working patterns.

Many people (and businesses) have realised the benefits of working from home. According to Zoopla, more than 1 in 5 people are planning to move in the next 18 months as a direct result of the pandemic – with changing working patterns being the main driver.

After all, if you can work from home anywhere, why not move to where you want to live?

This could have the effect of boosting demand in certain areas – particularly if people are moving out of big business areas such as London, Manchester, and Birmingham.

So, what is likely to happen to property prices in 2022?

Given the factors that you’ve read about in this article, we’d suggest that you’ll see a natural drop-off in new property sales activity and the potential for interest rate rises in 2022.

There are also some severe economic headwinds facing the government, which could prompt many people to “hunker down” and stay put for now, rather than risk taking on either new, or more, mortgage debt.

Leading estate agents, Rightmove, are predicting a national rise of 5% in 2022. That’s very much at the top end of predictions, however, with Zoopla forecasting a 3% increase and the OBR just a 1.3% rise.

Indeed, a more pessimistic prediction from Oxford Economics forecasts a 1.4% fall in prices in 2022.

Get in touch

As you’ll have read in this article, no one can predict the future. However, we do have a wealth of experience when it comes to helping our clients plan their financial future.

If you think we can help you, please get in touch.

You can email us at enquiries@blackswanfp.co.uk or contact your adviser on 020 3828 8100.

Production

Production