Why you should swap your weekly cappuccinos for financial peace of mind

Posted onHave you ever wondered how much you spend on ‘little things’ each month? How many coffees or snacks do you buy when you are out and about? Do you subscribe to magazines you never read? Do you order in takeaways every week?

A couple of cappuccinos each week might only cost you £5 or £6. But, over the course of a year, that could add up to more than £300.

According to KPMG, the average Londoner spends £709 on takeaways every year.

And, buying a couple of bottles of wine a week could set you back more than £600 a year[1].

Research from insurer Royal London has found that giving up a couple of lattes a week could buy you over £50,500 of life or critical illness cover[2]. This shows that making small changes to your spending can have a significant impact on your financial future. And, perhaps not being able to do many of these things during lockdown has shown you how easy it is to cut your spending?

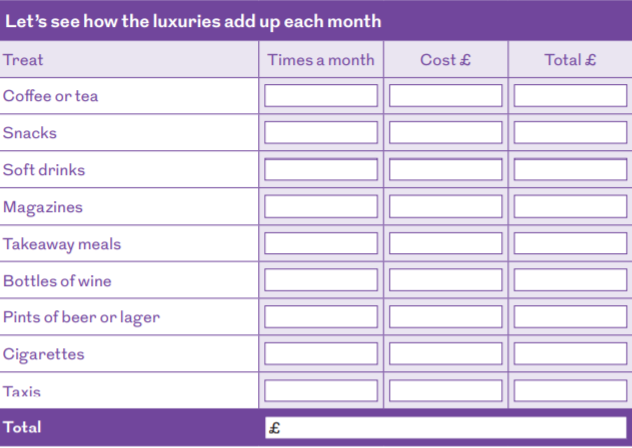

To find out how much you’re spending on life’s little luxuries, tot them up here. You might be surprised how much cover you could get by swapping just one or two.

[1] Based on the cost of a bottle of wine from UK supermarkets, November 2019.

[2] Royal London Personal Menu Plan, November 2019, £22 per month, based on a couple aged 29, both non-smokers, £50,518.60 level cover.

Now you know how much you spend on ‘little things’, here’s why ditching a takeaway, a pint or a latte could give you huge financial peace of mind.

Swap your takeaway for peace of mind

Being diagnosed with a serious illness can happen to anyone at any time. In the UK, someone is diagnosed with cancer every two minutes. Someone is admitted to hospital because of a heart attack every five minutes. And, strokes cause around 36,000 deaths in the UK each year and are the biggest cause of severe disability.

Even if you are eligible for Statutory Sick Pay (SSP) it is currently less than £100 per week, and only paid by your employer for up to 28 weeks.

Critical illness cover provides you with the peace of mind that you will receive a tax-free lump sum if you are diagnosed with a serious medical condition such as cancer, multiple sclerosis, or a severe heart attack.

This tax-free lump sum can be used to:

- Pay off some or all of your mortgage

- Replace your income if you’re unable to work while you recuperate

- Make necessary adjustments to your home

- Pay for specialist or private medical treatment

An additional benefit that you can take advantage of is that most policies also include children’s critical illness cover.

This means that, if your child is diagnosed with a critical illness covered under your policy, you could benefit from a tax-free lump sum. This is typically a percentage of the overall cover or a fixed amount (often in the region of £25,000).

Figures from the Association of British Insurers show that insurers paid almost 18,000 critical illness claims in 2019. Almost 92% of all claims were paid, with an average payout of £67,573. Cancer was the biggest single reason for an individual critical illness claim.

This means that thousands of individuals received a valuable injection of capital at a difficult time, allowing them to concentrate on their recovery rather than how they would pay their bills.

Get in touch

Being diagnosed with a serious illness is a life-changing experience and having financial support in place means you have one less thing to worry about at an extremely stressful time.

Giving up a takeaway each month or cutting down on the snacks or drinks that you buy, could enable you to benefit from this valuable protection.

To find out more, speak to your Black Swan financial planner. Email enquiries@blackswanfp.co.uk or call 020 3828 8100.

Production

Production