3 in 5 homeowners are considering using equity release to fund their retirement plans

Posted onHomeowners worried they could face a financial shortfall in retirement are already considering using their property wealth to fund their plans. While equity release could provide a capital injection to reach retirement goals, it’s important to weigh up the pros and cons first.

According to a survey conducted by the Equity Release Council (ERC), 3 in 5 homeowners are interested in releasing money from their property later in life. Indeed, only 26% of homeowners rule out the possibility of accessing some of the money that’s tied up in their homes in the future.

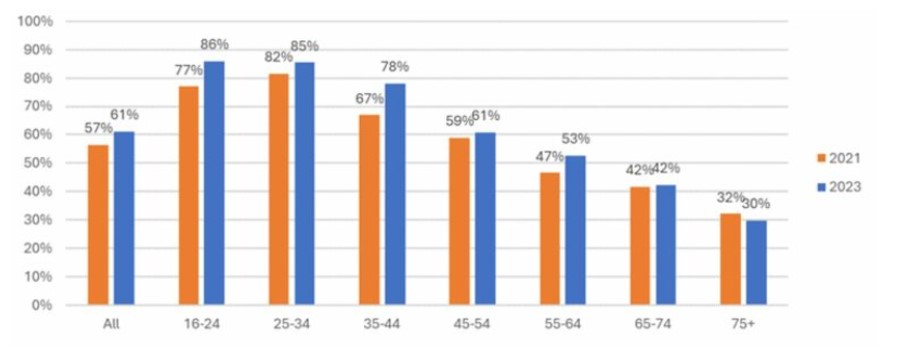

It’s not just those nearing the milestone that are contemplating how they’ll finance their retirement either. In fact, as the graph below shows, younger homeowners are more likely to be interested in unlocking property wealth later in life.

Source: Equity Release Council

Given that many workers feel pessimistic about their retirement and the amount they’re saving, it’s perhaps not surprising that they’re considering how they might use their property.

PensionBee’s Pension Confidence Index found that only 54% of those aged between 55 and 64 felt positive about their pension. The most common reason for negative sentiments is wishing they’d saved more for retirement. Younger generations feel equally gloomy about their retirement prospects.

So, if you’re worried about your financial security once you stop working, considering how to use property, which is often among your largest assets, can be attractive.

Equity release could provide you with a lump sum to fund retirement

The most common type of equity release is known as a “lifetime mortgage”. You’ll usually need to be aged 55 to be eligible for a lifetime mortgage.

A lifetime mortgage is essentially a loan that’s secured against your home. However, unlike traditional loans, it usually isn’t paid back until you die or move into long-term care. As a result, it could boost your retirement income without expenses rising.

You can choose to receive the money released from your property as a lump sum or through drawdown, which would allow you to access more as and when you need to.

According to the ERC, in the first quarter of 2024, new drawdown customers agreed on an average loan of almost £115,000 and took just over £59,500 upfront. The average customer accessing property wealth as a lump sum received almost £103,500.

The amount you could receive through equity release would depend on the value of your property and your circumstances. Typically, you can access between 20% and 60% of the property’s market value. So, a lifetime mortgage has the potential to provide a sizeable income boost that could make your retirement more comfortable.

However, as you usually don’t make payments on a lifetime mortgage, the amount you owe can rapidly increase.

The compounding effect could mean the debt rises quickly

A key drawback to using a lifetime mortgage is that the outstanding debt can rise rapidly due to the effects of compounding.

The interest on a lifetime mortgage is usually rolled up, as you don’t have to make regular repayments, you end up paying interest on the original sum you borrowed and the interest that has already been accrued.

Calculations from Standard Life highlight how this could affect the amount you owe.

Let’s say you borrow £81,703 with an interest rate of 6.74%. In the first year, £5,681 would be added to the amount you owe. Assuming you didn’t make any repayments, in the second year, the amount of interest added would rise to £6,075.

Over a long time frame, this compounding effect can really add up. Indeed, in the above scenario, after 15 years, the interest added would rise to £14,555 and your outstanding balance would be £233,915 – over £142,000 more than you initially borrowed.

So, equity release could have a huge effect on the value of your estate and what you leave behind for loved ones.

It’s worth noting that many lifetime mortgages will allow you to make interest payments without paying a fee. As a result, you could reduce how much the outstanding balance grows, but you’ll need to consider how it might affect your budget in retirement.

There are other drawbacks to consider if you’re thinking about using equity release too, such as:

- You may need to pay an early repayment charge if you choose to repay all or part of the loan early.

- If you’re entitled to means-tested benefits, receiving capital through a lifetime mortgage could mean you’re no longer eligible.

- You usually won’t be able to take out another loan against your home, so your options could be limited if you want to borrow more.

- A lifetime mortgage might make it more difficult to move home, so you may want to consider whether your property will suit your needs over the long term.

It’s important to weigh up these potential disadvantages before taking out a lifetime mortgage to ensure it’s the right decision for you.

Contact us if you have any questions about equity release

If you think equity release could be a useful way to fund your retirement, please get in touch. We’re here to answer any questions you might have and help you understand if it could be right for your circumstances.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.

Equity release will reduce the value of your estate and can affect your eligibility for means-tested benefits.

A lifetime mortgage is a loan secured against your home. To understand the features and risks, ask for a personalised illustration.

Production

Production