5 reasons to shop around for a better savings account

Posted onInterest rates have been increasing over the last 18 months and that could be great news for savers. It means that, if you are proactive and you move your cash savings around to find a higher interest rate, you may see your wealth grow faster.

Unfortunately, a recent poll reported by Wales Online found that half of Brits have never switched their savings account.

A quarter of those surveyed said that it was “too much hassle” to switch, while 76% said they would have to get an extra £150 a year in interest for it to be worthwhile. Even among those that do switch, 21% only do so every two to five years.

As such, you may not have reviewed your savings account for a while.

Perhaps you think that your provider will reward you for your loyalty, or you don’t think that you have much to gain from switching? Or, maybe you just haven’t got around to it yet?

Whatever your reasons, you could be missing out on hundreds or even thousands of pounds in lost interest by not switching to a new provider.

Read on to learn why you may want to shop around for a different savings account.

1. Switching to a different savings account could boost your wealth by hundreds of pounds a year

You may be sticking with your current savings account because you don’t feel that switching is worthwhile, even if you do find a slightly higher interest rate.

The survey from Wales Online reflects this as 76% of people said that they would only switch if they earned £150 or more in interest as a result. The implication is that those people assume they wouldn’t be able to earn an additional £150 in interest by changing their savings account.

The reality is, you may be able to earn significantly more than this.

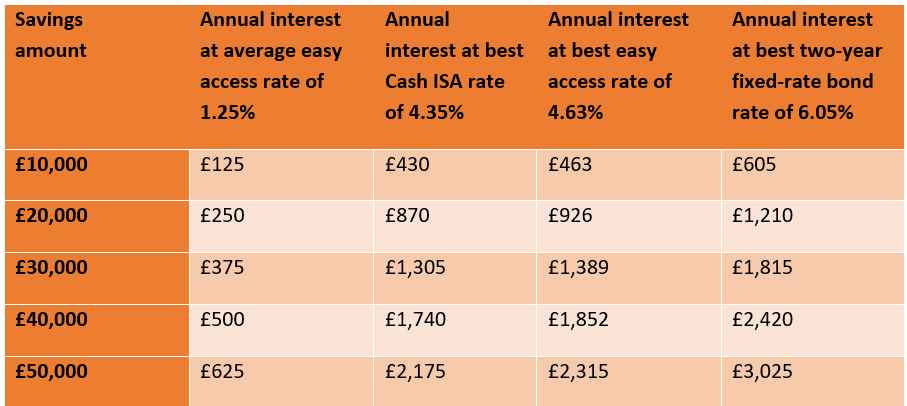

The following table shows how much interest you could generate from the best:

- Cash ISA – 4.35%

- Easy access savings account – 4.63%

- Two-year fixed-rate bond – 6.05%

These interest rates are compared with the average easy access savings rate of 1.25% offered by high street banks.

Source: Moneyfacts – rates for easy access accounts, Cash ISA, and two-year fixed-rate bonds correct on 8 August 2023, average easy access rate as reported by the Guardian

As you can see, if you moved £10,000 in cash savings from an easy access savings account with a high street bank into the best easy access account available, you could earn an additional £338 a year in interest.

The difference may be even larger if you have more in your savings. Moving £50,000 from the average high street easy access account to the best two-year fixed-rate bond could increase your annual interest by £2,400.

Additionally, you generate compound interest on this amount in subsequent years.

As such, being proactive and moving your cash savings on a regular basis to get the best interest rates could mean that you see significantly higher levels of growth over an extended period.

2. High street banks don’t always offer the best interest rates

High street banks with good name recognition may be your first port of call when you are looking for a new savings account. However, you could find a higher interest rate if you shop around and consider alternatives.

Indeed, according to the Guardian, the average interest rate on easy access savings accounts from high street lenders rose from 0.7% to just 1.25% between January 2022 and May 2023.

In comparison, Moneyfacts shows the best easy access savings account interest rate on 8 August was 4.63%. This is considerably higher than any of the high street banks.

There are many smaller banks and building societies offering competitive rates and the rates on offer change all the time. So, by shopping around and considering all your options, not just providers you already know, you may be able to find much higher interest rates.

3. The Financial Conduct Authority says banks must pass on higher interest rates

The last few years have been characterised by high inflation, and interest rates have been rising as a result.

Indeed, the Bank of England (BoE) increased the base rate again to 5.25% in August in an attempt to curb rapidly rising prices.

This is the 14th consecutive increase and you have likely seen news stories about the effect that this is having on mortgage costs.

However, the interest rates on savings accounts are not keeping pace with the base rate rises – and banks have faced criticism for this.

According to a press release from the Financial Conduct Authority (FCA), nine of the biggest savings providers only passed on around 28% of interest rate rises to easy access savings account customers.

In response to this, the FCA set out clear guidelines requiring banks that offer the lowest savings interest rates to justify how those rates provide fair value to customers. They must do this by 31 August and if they cannot, the FCA will take action against them.

As such, many banks may be forced to increase the interest they offer on their savings accounts soon. This means you may be even more likely to find a higher interest rate than the one you have with your current provider.

4. You can change the access you have to your savings

As you move through life and your circumstances change, your financial goals likely change too. This could mean that the most suitable type of cash savings account for you may be different today than it was in the past.

That’s why switching your savings account is also a good opportunity to review the access that you may need to your cash savings.

For example, if you want to draw on your savings more often to fund holidays or a new car, a fixed-term savings account may not be suitable because you could face charges for withdrawing the funds early. In this case, you would likely benefit from an easy access savings account instead.

Alternatively, if you have savings in an easy access account that you are not likely to need in the next two to five years, you could get a better rate by switching to a fixed-term bond.

Additionally, if you have funds that you do not need to access in the short- to medium-term, you may want to consider investing them instead of holding them in cash savings.

This may be particularly beneficial right now as inflation has a sustained effect on your cash savings and investing offers the potential for growth that keeps pace with inflation.

Remember, though, that the value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

5. It is easier than ever to switch

A quarter of people surveyed said that switching their savings account was “too much hassle” but this simply is not true.

Perhaps in the past you needed to go into a branch and provide various bits of paperwork to open a new savings account, but that is not the case anymore.

You can open most savings accounts online, and the process is normally quick and easy.

So, if you are willing to take a small amount of time out of your day to shop around and switch your savings account, you may see your wealth grow more as a result.

While generating more interest is a positive, this could mean that you pay more tax on the interest if you exceed your Personal Savings Allowance. It is important to be aware of this when deciding how much of your wealth to hold in a cash savings account.

Get in touch

Finding the right balance between cash savings and investments can help you grow your wealth more effectively. We are here if you need guidance on this.

Email enquiries@blackswanfp.co.uk or contact your adviser on 020 3828 8100.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Production

Production