8 good reasons why you should keep track of your pensions

Posted onWorking patterns have changed.

Previous generations would have considered a working life spent with the same employer throughout as perfectly normal. But, these days, that kind of employment record is very much the exception rather than the norm.

This means that the way you save money into your pension has changed as well.

According to recruitment experts Zippia, the average person changes jobs 12 times in their working life. That’s potentially 12 different employer pension schemes, on top of any private arrangements you set up.

That can make it difficult to keep track of all your different pension pots. Even more so given the regularity with which pension providers merge, change their name, or sell tranches of their business to scheme administration specialists.

This year, as well as being Halloween, 31 October is the first National Pension Tracing Day. Different businesses across the pension industry have come together to raise awareness of the estimated £19 billion sitting in pension pots that has been either lost or forgotten.

31 October is also the day the clocks go back, so why not use the extra hour to start tracking down all your old pension pots?

Here are eight good reasons why you should.

1. It makes sense to know the value of all your pension funds

As a starting point, it’s always good to know how much money you have saved for your retirement. By tracking down all your different pension pots, you’re on the first step towards knowing exactly what you’ve got and where it is.

Knowing what you have is crucial when it comes to planning your retirement. You’ll be able to see if you’re on track to build the fund you need to live a comfortable life after you stop working, or if you need to take steps to boost your fund by increasing the amount you contribute.

2. You might not realise the money is there

Before auto-enrolment introduced a level of compulsion around employer pension schemes, different employer-sponsored schemes had different joining criteria.

For example, some stipulated that you had to be over age 21 with two years’ service. In others, you joined the scheme after just six months’ service. So, it’s perfectly understandable if you didn’t know you were accruing benefits in a pension.

Also consider that, when you were young, saving for your retirement might not have been at the forefront of your mind. You may well have skimmed over the pension details outlined in your contract looking for, at the time, more important information like your holiday entitlement.

So, it may be the case that you have pension pots you didn’t know about. It’s worth the effort to find them, as they could each play a part in supporting your retirement lifestyle.

3. You could be paying too much in charges

By tracking down all your pension funds, you’ll be able to get clear information about how your money is invested and the charges you’re paying. These will include management charges to the scheme administrators for looking after your money, and investment charges to the relevant fund managers.

High charges can eat away at the value of your fund.

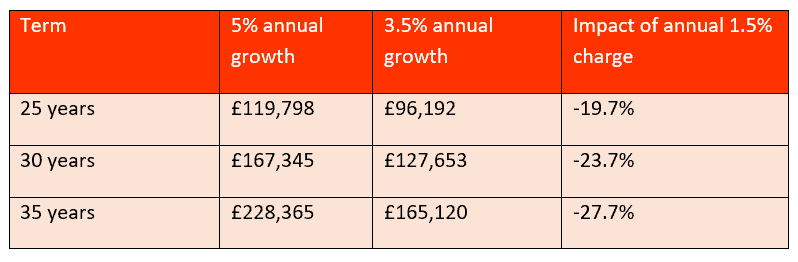

For example, this table shows the impact of annual charges of 1.5% as you save £200 a month for different time periods.

Source: Calculatorsite.com

As you can see, in the long term, the impact of high charges can dramatically reduce the value of your pension pot. Tracking down old pensions may mean you can switch them to lower-charging funds.

4. Your money may be invested in inappropriate funds

As well as potentially high charges, your pension pot might be invested in funds that aren’t appropriate for your needs.

As your retirement plans change closer to the time you’ve decided to stop work, so your investment strategy will need to adapt.

This means that the fund, or funds, you may have chosen when you were 30, with at least three decades in front of you before retirement, may no longer be the best investment choice closer to retirement.

By getting the details of all your pension pots, you can take steps to ensure your investment choices match your requirements.

5. Consolidation might be the best move

Once you’ve tracked all your pensions, you might want to consider consolidating all your plans together into a single arrangement.

There are several advantages for doing this. These include:

- A single plan is easier to manage. You’ll just have one scheme with one set of paperwork

- It provides a single view of your pension, which can make retirement planning much more straightforward

- You may be able to save money by reducing administration and investment charges.

However, you should note that consolidating isn’t always the best thing to do.

You might potentially lose out on guaranteed benefits from current schemes or lose access to low charges negotiated by a previous scheme administrator.

We would recommend that you speak to an experienced financial adviser before taking the decision to consolidate your pensions.

6. Schemes might not be able to find you

Another good reason for tracking down all your pension pots is that some schemes may not be able to find you.

If you’ve changed address several times, any correspondence they may have sent you could well have ended up being returned to them marked “gone away”.

Most providers and administrators will make an effort to try and trace you, but if you’ve lived in a series of properties, and even spent some time abroad, it’s easy to see why they might struggle to ascertain your whereabouts.

7. You could be missing out on a lot of money

The £19 billion lost or forgotten pension money that we referenced in the introduction is spread across 1.6 million pension pots. That means that each pot is worth an average of around £12,000.

It would only take two or three of those pots to be yours for you to be missing out on a substantial sum. And don’t forget that £12,000 is an average, so many pots will be much bigger than that.

8. There’s a government website to help you trace your pension pots

You can make a start by listing all your employers and then checking through your paperwork and online records for details of any pension arrangements.

If you’re unable to find any records, there’s a government website to help find the contact details of any employer schemes you might have been a member of, or personal arrangements you may have set up yourself.

Get in touch

Once you’ve tracked down all your pension pots, the next step is to start putting a plan together to ensure you’re on track to enjoy a comfortable retirement.

To find out how we can help, email enquiries@blackswanfp.co.uk or contact your adviser on 020 3828 8100.

Production

Production