First-time buyers: Could you benefit from the 5% deposit Mortgage Guarantee Scheme?

Posted onThe government has extended a scheme that means homebuyers could access a mortgage with a lower deposit. If you’re hoping to purchase a property this year, it could make your goals a little bit closer.

As house prices have climbed while wages have stagnated for many workers, saving a deposit is often one of the initial hurdles first-time buyers face.

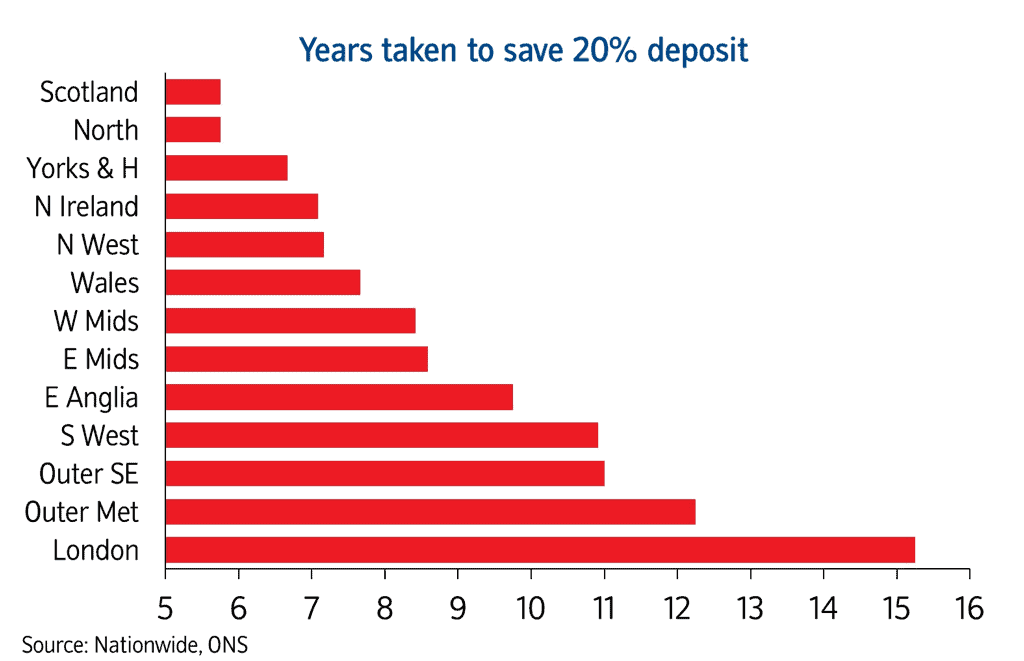

Indeed, a report from Nationwide suggests that first-time buyers aiming to save a 20% deposit can expect to save for at least six years, assuming they put aside 15% of their take-home pay. In more expensive regions, aspiring homeowners could be saving for over a decade to reach their goal.

The below graph shows how long it could take a first-time buyer to save a 20% deposit depending on where they live.

Source: Nationwide Building Society affordability report

The research also found that around a third of first-time buyers rely on some help to raise a deposit. This often comes in the form of a gift or loan from family members or an inheritance. While financial support is important for many first-time buyers, it’s not always an option.

If you’re struggling to save a deposit to buy a home, the government’s guarantee scheme could help.

The Mortgage Guarantee Scheme could help you buy a home with a 5% deposit

The government launched the Mortgage Guarantee Scheme in April 2021 and, so far, it’s helped more than 24,000 people get on the property ladder. It’s now been extended until the end of 2023.

Traditionally, first-time buyers have put down a 10% deposit. Under the scheme, the government offers lenders financial guarantees to provide 95% mortgages, so you could need just a 5% deposit.

According to the Halifax House Price Index, the average property was worth a little over £280,000 in December 2022. So, using the mortgage guarantee scheme, you’d need a deposit of around £15,000. Of course, the area and property you’re hoping to buy will have a significant effect on the deposit you need.

The scheme can be used for a mortgage on a house worth up to £600,000. You don’t need to be a first-time buyer to make use of the scheme. Around 15% of people who have already benefited were not buying their first home.

4 important things to consider if you’re thinking about using the Mortgage Guarantee Scheme

1. Does putting down a smaller deposit make sense for you?

While paying a smaller deposit can seem like an obvious solution, it doesn’t always make financial sense. If you can, putting down a larger deposit, even if it means saving for longer, could save you money in the long run.

Your mortgage interest rate is linked to your loan-to-value (LTV) ratio – this compares the value of your home to the amount you owe through your mortgage. Typically, the lower your LTV, the better the interest rate you can access. A lower interest rate means your monthly repayments and the total cost of borrowing will be lower.

As a result, putting down a larger deposit could make financial sense.

Whether buying a home with a smaller deposit makes sense for you will depend on your personal circumstances, such as if you’re currently renting. So, you should weigh up your different options and understand how your deposit size could affect the cost of your repayments.

2. Are you in a financial position to apply for a mortgage?

While the government’s scheme is designed to give banks and building societies the confidence to provide low-deposit mortgages, it doesn’t guarantee that your application will be accepted.

Lenders will still assess your affordability and financial circumstances. Before you apply, it’s worth checking your credit report and seeing if any red flags could put a lender off. There are often things you can do to improve your credit score if necessary, such as registering on the electoral roll or reducing credit card debt.

Lenders will have different criteria. Understanding what they’re looking for or working with a mortgage broker can help you choose one that’s appropriate for you.

3. Will your mortgage repayments be affordable?

Rising house prices aren’t just affecting the deposit you need to save – it will affect your repayments too.

The Nationwide research found that affordability is now well above the long-run average. First-time buyers will typically spend 39% of their take-home pay on mortgage repayments. The figure is close to the levels seen in the run-up to the 2008 financial crisis.

Even if a lender approves your mortgage, you should review your budget and ensure you feel comfortable that you can meet repayments alongside other financial commitments.

4. Could you afford your mortgage if interest rates increased?

Throughout 2022, the Bank of England increased its base interest rate several times to tackle soaring inflation. The rate increases affected thousands of mortgage holders, who saw their regular mortgage payments rise if they had a variable- or tracker-rate mortgage.

So, it’s worth considering if your budget could stretch to accommodate potential interest rate rises in the future. Understanding how much you could afford can give you confidence that you’ll be able to meet your mortgage repayments even if they change.

If you’re worried about how you’d cope financially if interest rates increased further, you may want to consider a fixed-rate mortgage. With this option, your interest payments would be fixed for a defined period, so your repayments wouldn’t increase during the term. However, if interest rates fell, you also wouldn’t benefit from lower mortgage repayments.

Do you have questions about getting on the property ladder?

If you’re a first-time buyer and have questions about getting on the property ladder, including understanding which type of mortgage is right for you, we can help. We can work with you to find a suitable mortgage that considers your financial circumstances. Please get in touch to arrange a meeting.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.

Production

Production