Interest rates are rising. What does it mean for your mortgage?

Posted onAt the end of 2021, the Bank of England (BoE) raised its base interest rate from 0.1% to 0.25%. Then, the Bank increased the rate further in February to 0.5%, and now it has increased again to 0.75%. While the changes may seem small, they can have a significant effect on your mortgage – and further increases could happen this year.

The BoE’s base rate has been low since the 2008 financial crisis. This has meant the cost of borrowing has been cheap so, as a homeowner, you may have enjoyed more than a decade of relatively low interest rates.

The gradual increases the Bank has announced over the last few months could signal that interest rates will return to more “normal” levels during the coming years.

For some mortgage holders, the increase will already have had a direct effect on their mortgage repayments. For others, it could affect the amount of interest they pay when their current mortgage deal comes to an end.

Why is the Bank of England increasing interest rates now?

The main reason for the rising interest rate is inflation.

The BoE has a target of keeping the rate of inflation at 2%. This aims to keep the rising cost of living low and stable. However, the effects of the Covid-19 pandemic has led to inflation of more than double this target. In February 2022, the inflation rate reached 6.2% – the highest rate in 30 years.

One of the steps the BoE can take to control inflation is to increase interest rates. This is because higher interest rates discourage spending and encourage saving.

For mortgage holders, rising interest rates could place finances under pressure. Not only is the cost of living rising, meaning things like your energy bill and grocery shopping are costing more, but your mortgage repayments could increase too.

How will your mortgage bill increase?

How your mortgage will increase will depend on several factors, including how much you’ve borrowed, the interest rate you have, and the type of mortgage you hold. Understanding how rate rises will affect your outgoings can help you budget effectively.

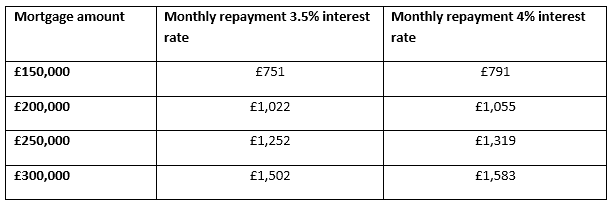

An interest rate rise from 0.1% to 0.75% doesn’t seem like a lot, but it can add up. The below table highlights how a 0.5% difference in interest rates could affect your monthly outgoings if you had a 25-year repayment mortgage.

Source: Money Saving Expert

As your monthly payments rise, so too does the total cost of borrowing. In the above example, a mortgage of £250,000 with a 3.5% interest rate would mean you pay £125,596 in interest over the full term of the mortgage. This rises to £145,712 if the interest rate rises by just 0.5%. While the increase can seem relatively small it can mean the cost of borrowing is much more expensive.

If you have a variable- or tracker-rate mortgage, your interest rate may already have changed. If you have a fixed-rate mortgage, the interest you pay will remain the same until your deal ends.

Searching for the right mortgage deal for you can help you access a more competitive interest rate. If your mortgage deal has come to an end, shopping around is essential – it could save you money now and over your full mortgage term.

Here are five things to consider when you’re looking for a new mortgage:

1. Do you want a fixed-, variable-, or tracker-rate mortgage?

A fixed-rate mortgage will mean you know how much interest you will pay for a fixed period. With a variable- or tracker-rate mortgage, your repayments could rise or fall.

2. How much do you need to borrow, and what will the loan-to-value (LTV) be?

When you’re looking for a new mortgage, you may want to pay off a lump sum, reduce how much you owe, or increase the amount you borrow. You should also consider how the amount you’re borrowing compares to the value of the property. This is known as the LTV, and the more equity you hold in the property the lower the rate of interest you will generally pay on your mortgage.

3. What will your mortgage term be?

When taking out a new mortgage, you can choose to review the term. You may want to repay it quicker, which will result in higher monthly outgoings but you’ll pay less interest over the full term. Alternatively, you may want to extend the term to lower your repayments.

4. What is the level of interest rate you will pay?

The interest rate offered by different lenders will vary so it’s important to shop around and compare them to help you find the right deal for you.

5. Do you want the flexibility to overpay your mortgage?

As well as the interest rate, other features may be important to you when looking for a mortgage. If you plan to make overpayments to reduce the debt quicker, some mortgages will allow you to do this without facing an additional charge.

As well as setting out what you want from a mortgage, you also need to consider if a lender will approve your application. Understanding the criteria of a mortgage lender can be difficult, but we’re here to help you. Please contact us to discuss your mortgage needs.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Production

Production