Why it could pay to use your 2023/24 tax year allowances right now

Posted onThe new tax year has only just started. Yet, making the most of your allowances now, rather than waiting until March 2024, could make sense. Read on to find out why.

When a new tax year starts on 6 April, many allowances reset, such as the:

- ISA allowance

- Pension Annual Allowance

- Capital Gains Tax annual exempt amount

- Dividend Allowance

Using allowances could reduce your tax liability and improve your long-term financial security. So, they should be part of your financial plan.

In the past, you may have waited until the end of the tax year to calculate how much of your allowances you’ve used and then potentially made the most of remaining allowances. However, taking some time to assess how you’ll use appropriate allowances now could be useful – here are four reasons why.

1. Avoid making last-minute decisions

If you wait until the end of the tax year, you may find you need to make decisions quickly. It could mean you overlook potential opportunities or choose an option that isn’t right for you. By going through your allowances now, you can give yourself plenty of time to understand how your decisions could affect your short- and long-term finances.

Making use of allowances now also means you don’t have to worry about delays and a looming deadline.

2. Benefit from an extra 12 months of returns or interest

Do you want to boost your savings or investments over 2023/24? Thinking about how allowances could help you reach your goal now could mean you benefit from an extra 12 months of interest or returns.

The ISA allowance, for instance, allows you to save or invest up to £20,000 tax-efficiently in the 2023/24 tax year. You don’t need to pay Income Tax on interest or Capital Gains Tax (CGT) on returns if your assets are held in an ISA. As a result, they could form an essential part of your financial plan.

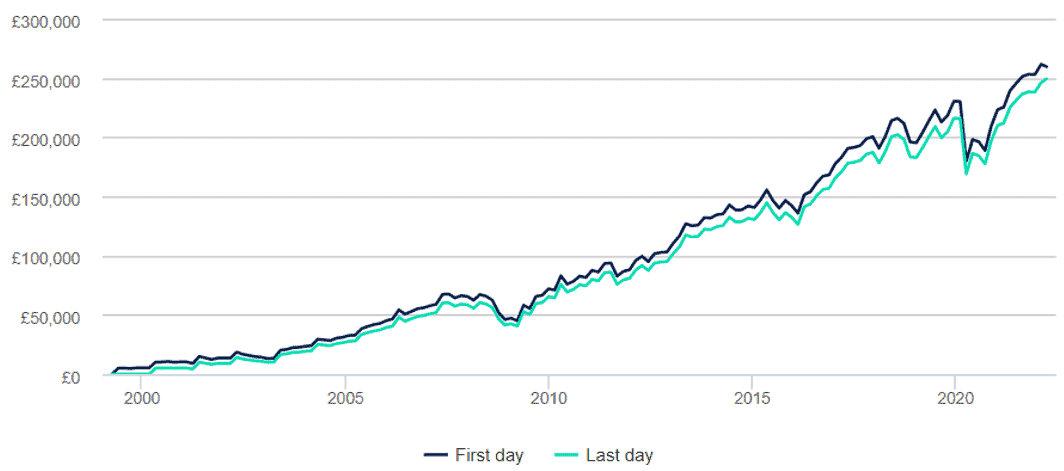

Analysis from Hargreaves Lansdown has highlighted that when you deposit money in a Stocks and Shares ISA could affect the value.

If you invested £5,000 each tax year in the UK stock market between 1999 and 2022, you’d be more than £10,000 better off if you invested at the start of each tax year, rather than waiting until the end. So, if you have a lump sum to invest, you may want to consider using your allowance now.

Source: Hargreaves Lansdown

Of course, investment returns cannot be guaranteed, and you should remember that markets experience volatility. As a result, investing with a long-term time frame and choosing investments that suit your risk profile is essential.

Similarly, if you use your ISA allowance to boost savings, doing so sooner means you’ll likely benefit from more interest. As interest rates have increased over the last year, it’s worth checking if your Cash ISA rate is still competitive. Transferring your ISA to a provider with a higher interest rate could boost your savings even more.

3. You can spread out contributions over the tax year

If you don’t have a lump sum available to use your allowances now, a plan at the start of the year can still be valuable. It means you could spread out contributions and make it part of your budget.

Let’s say you want to add an extra £5,000 to your pension from your take-home pay this tax year. Rather than depositing a lump sum, setting a direct debit of around £420 each month can ensure you stay on track as it will become part of your regular outgoings.

As your pension is usually invested, spreading out contributions throughout the year means you’ll be investing at different points of the market cycle. This can help balance market volatility, as investing when the market is high could be offset by a contribution that’s made when it’s low.

The same principle also applies if you’re investing in other ways too, such as through a Stocks and Shares ISA.

4. Ensure your decisions reflect your goals throughout the year

Setting out how you want to use tax breaks this year can help ensure your financial decisions reflect wider goals. Reviewing your finances now is an opportunity to see what steps you can take to move closer to aspirations like retiring early, purchasing property, or lending financial support to loved ones.

Contact us to talk about your plan for the tax year ahead

If you want to discuss how you could make use of 2023/24 tax allowances now or throughout the year, please contact us. We can help you understand which allowances could support your long-term goals.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future results.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts.

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

Production

Production