Why the collapse of Silicon Valley Bank is a timely reminder about how to hold cash savings

Posted onThe collapse of Silicon Valley Bank (SVB) on 10 March represented the biggest failure of a large financial institution since the global financial crisis. And, when UBS had to step in to buy Credit Suisse just days later, fears of a repeat of the 2008 financial crisis began rising.

While the system remained stable, this major upset in the banking industry raises an important point about how you should hold your assets, particularly your cash.

Read on to find out more about SVB’s collapse and for a reminder as to the protection you have for your cash savings.

SVB sold $2.5 billion in shares and caused panic that led to their collapse

Though it only took 48 hours of panic for SVB to collapse, the crisis was rooted in financial decisions made several years before.

Like many other banks, SVB heavily invested in government bonds when interest rates were close to zero. At the time, they appeared to be a safe investment, but when inflation spiked and the Federal Reserve raised interest rates to combat it, the value of bonds plummeted.

Additionally, higher interest rates increased borrowing costs, putting more financial pressure on the many tech startups that banked with SVB. These companies began drawing down more of their funds to cover increased debt repayments and operational costs.

The collapse was sparked when SVB announced they were selling $2.25 billion in new shares to recoup the losses and plug the financial gap. This caused panic among SVB customers, who started withdrawing their cash in large amounts, sending the bank into a downward spiral.

SVB share prices dropped 60% on Thursday 9 March, causing other bank shares to fall too as concerns of a financial crisis grew.

By Friday morning, SVB had stopped trading shares and given up on efforts to raise more capital and find a buyer. At this stage, regulators stepped in and placed the bank in receivership under the Federal Deposit Insurance Corporation. Essentially, this means the bank was liquidated and remaining assets were used to pay back depositors and creditors.

US regulators also agreed to cover customers’ deposits if there were not enough remaining assets to foot the bill, but investors in SVB stocks and bonds were not protected. HSBC stepped in to buy the UK arm of SVB for £1 to protect the deposits of UK customers.

As you followed the situation unfold on the news, you may have wondered what would happen to your cash savings if your bank went the same way.

The Financial Services Compensation Scheme (FSCS) offers limited protection for your savings

Fortunately, there are protections in place if a bank or other financial institution collapses, so your savings will likely be safe. However, it’s worth remembering that protection is limited, and if you hold a large amount of cash, the FSCS may not cover the full amount.

In the event of a collapse, the FSCS protects up to £85,000 per eligible person, per institution, or £170,000 for joint accounts.

In certain cases, they may protect qualifying temporary high balances up to £1 million, but only for six months after the money is deposited. This accounts for things like:

- Compensation payments

- Property transactions

- Redundancy payments

- Inheritance.

One important thing to be aware of is that different accounts with banks that are in the same banking group – sharing the same banking licence – are treated as one bank by the FSCS. Consequently, the compensation limit applies to the total money across all accounts.

Some common examples of institutions that share a banking licence include:

- HSBC and First Direct

- Halifax, Bank of Scotland, and Birmingham Midshires

- Virgin Money, Clydesdale Bank, and Yorkshire Bank

- Nationwide Building Society, Cheshire Building Society, Dunfermline Building Society, and Derbyshire Building Society.

So, if you held £85,000 with Halifax, Bank of Scotland, and Birmingham Midshires, the FSCS would only protect £85,000 of your savings (£170,000 if you have a joint account).

If you are not sure which banking group owns your bank, you can use this simple search tool from Which? to find out. You can also use the FSCS protection checker to see if your money is protected.

If you do have more than £85,000 in a single account (or across multiple accounts within the same banking group) you may want to consider moving some of your savings to different institutions, so you are fully protected by the FSCS in the event of a failure.

Cash may not be the safest option

Even if you have less than £85,000 in savings and the FSCS will automatically protect you if something happens, holding large amounts of cash could be slowing your progress towards your goals. That’s because inflation could reduce the value of your money in real terms.

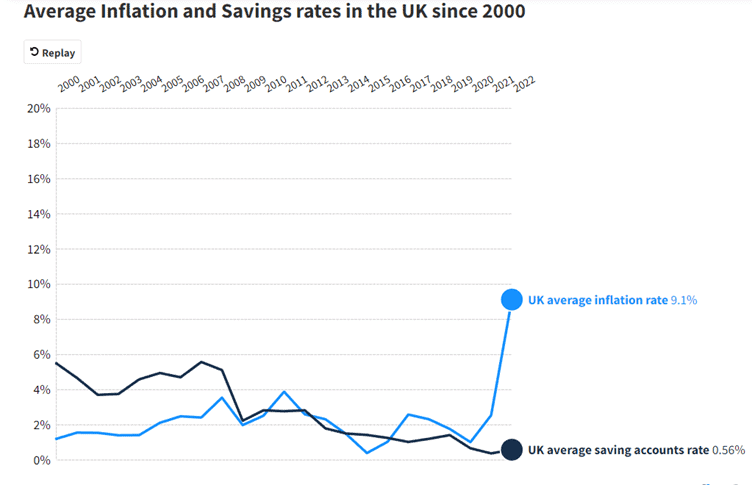

Figures from Finder show that the average savings account interest rate in 2022 was 0.56%, while inflation was 9.1%.

As a result, if you leave your money in a savings account and inflation continues to outpace interest rates, your spending power decreases in real terms.

For example, the Office for National Statistics reported that, in the year to February 2023, inflation stood at 10.4%. That means £100 of goods and services a year ago cost, on average, £110.40 today.

As of 27 March 2023, Moneyfacts reports that the highest interest rate available on an easy access savings account is just 3.4%. Had you invested £100 a year ago, you’d have £103.40 now.

As you can see, the value of your cash has fallen in real terms – you can’t buy as much today as you could a year ago.

If you are saving for the medium to long term – typically five years or more – investing your money instead may give you greater potential for growth and more chance of outpacing inflation.

Get in touch

If you want to ensure your cash is protected, or you’d like to explore alternatives to savings accounts, we can give you the advice you need.

Email enquiries@blackswanfp.co.uk or contact your adviser on 020 3828 8100.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Production

Production