Why the fear of losses could be standing in the way of you achieving your long-term goals

Posted onAfter millennia of struggling to survive against the brutal reality of nature, the human brain is hardwired to avoid risk.

But though the fears of being eaten by a predator or getting lost in the wilderness are no longer a worry for most of us, humans are generally still risk-averse by nature. This can have ramifications for many aspects of your life, including your finances.

Consider this scenario. A friend suggests you flip a coin and if it lands on heads, they will pay you £20, but if it lands on tails, you will pay them £20.

Would you take that gamble?

Research suggests that most people would need the gain to be around double the loss to be willing to take the bet. In other words, your friend would need to pay you £40 if you won the toss, while your stake would still be £20.

This is known as “loss aversion” and was first noted by the Nobel prize-winning economist Daniel Kahneman, who died in March at the age of 90.

Read on to learn more about Kahneman and how his theory of loss aversion can affect investments and financial decision-making.

Kahneman is perhaps best remembered for his “loss aversion” theory

Among Kahneman’s many contributions to the fields of psychology and behavioural economics, his theory of loss aversion is perhaps what he is best remembered for.

The theory was first proposed in a 1979 paper, co-written by Kahneman and his long-time collaborator Amos Tversky.

Loss aversion suggests that, generally, people feel the pain of losing something more intensely than the pleasure of gaining something of equal value. You are inherently more averse to losses than you are motivated by equivalent gains.

InsideBE reports that in Kahneman and Tversky’s paper on the subject, they asked participants to imagine they had been given 1,000 Israeli shekels (ILS).

They then had to choose either to gamble the money and have a 50% chance of doubling it or losing it all, or simply be given an additional 500 ILS with no risk.

84% of people chose to take the 500 ILS.

The participants were then asked to imagine they had been given 2,000 ILS and were given a choice to gamble it, with a 50% chance of gaining or losing 1,000 ILS, or simply losing 500 ILS.

69% of people chose to gamble.

This experiment demonstrated that people are generally willing to take risks to try and avoid a loss, but they are not willing to do the same for a gain.

Why loss aversion could hamper your progress toward your financial goals

When it comes to your investments, the human propensity for loss aversion could mean you avoid taking risks and maintain a conservative portfolio that might not deliver the returns you need to achieve your goals.

Loss aversion might also lead you to sell stocks during a market downturn to avoid further losses, which could mean you miss out on future gains if and when the market rebounds.

During a dip, any fall in the value of your investments might result in a paper loss, but it isn’t until you sell those stocks that you will experience an actual loss. Whereas, keeping your investments gives your holdings a chance to recover, and markets have historically trended towards growth in the long term.

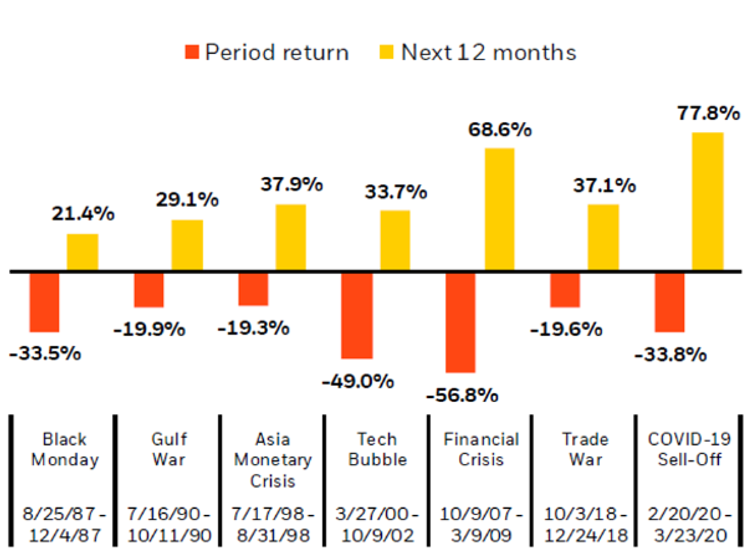

The graph below shows how average returns have fallen into negative numbers during various global crises since 1987, and then how they have bounced back in the 12 months after.

Source: Forbes

So, selling stocks during a market downturn may feel like the sensible thing to do, but historically, the market has continued to yield positive returns after dips.

How to limit the impact of loss aversion

The studies suggest that loss aversion is part of human nature and there is even evidence that human (and other animal’s) brain activity changes when anticipating a loss.

So, how can you limit the impact of loss aversion?

Recognise that you are likely susceptible to loss aversion

The research shows that you are likely to be among the majority of humans who are susceptible to loss aversion.

Awareness is the first step in overcoming any bias. Recognising that loss aversion exists and noting when it might influence your decisions is an important step in the process of mitigating its impact.

Then you can set yourself clear rules that can help you avoid making impulsive decisions based on emotions.

Remember that long-term goals usually necessitate long-term horizons

Instead of dwelling on short-term losses, keep your long-term objectives in mind.

Remind yourself that there is a bigger picture and that your journey toward your goals is a marathon, not a sprint.

As you saw earlier, the market tends to bounce back, so it can be wise to keep your focus on long-term horizons rather than being distracted by short-term volatility.

Diversify your portfolio

Diversification can help reduce the impact of losses in any single investment.

By spreading your investments across different asset classes, you can minimise the risk of significant losses affecting your entire portfolio.

Consider the opportunity cost of not taking action

When evaluating a decision, try to consider not only the potential losses but also the opportunity cost of not taking action.

Sometimes, loss aversion can prevent you from seizing valuable opportunities.

Speak to a financial planner

A financial planner can offer you an alternative point of view that is based on data and research rather than a cognitive or emotional bias, such as loss aversion.

If you want to talk to a financial planner, get in touch.

Email enquiries@blackswanfp.co.uk or contact your adviser on 020 3828 8100.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Production

Production