Why time in the market beats timing the market when it comes to investing

Posted on“Time in the market beats timing the market.”

It’s a common investment adage, sometimes described as the “golden rule” of investing. But constant repetition doesn’t make it any less relevant today.

“Timing the market” is a strategy by both professional investors and amateur stock-pickers. Their approach is to try and buy stocks when the value is low, and then sell when it’s high.

Sometimes it will work, and they will show a tidy profit. Frequently, however, even seasoned professionals fail to accurately predict market movements.

History and experience show that you’re more likely to see the value of your investments increase over an extended period if you simply sit tight and do nothing rather than constantly adjust your portfolio holdings. Read on to find out why.

Research shows the perils of trying to time the market

Research published in June 2021 by leading fund managers, Schroders, came up with some remarkable statistics that show the danger of trying to time the market rather than simply leaving your investments alone.

The headline revelation was that over 35 years – a common timeframe if you’re investing for your retirement – mistimed decisions on an investment of just £1,000 could have cost you almost £33,000 worth of investment returns.

The premise is based around the best 30 days of investment growth over that 35-year period and measuring the effect of missing out on those days.

If you’d invested £1,000 in the FTSE 250 in 1986, by leaving it alone your investment might have been worth more than £43,000 by the start of 2021.

Against that, if you’d tried to time the market, and you’d missed out on just the best 30 days of investment, you’d only have a fund value of £10,627.

In terms of annual investment return, that’s the difference between 11.4% each year or 7%.

Mistiming investment decisions can prove costly

Clearly the Schroders research cites extreme circumstances that are unlikely to have been replicated by an investor over that time period.

But what their analysis clearly shows is that by getting your timing wrong, you can cost yourself a lot of money.

Sometimes, the mistake can be due to overreacting to a particular event. As you’d have read in last week’s article, the FTSE 100 fell by nearly 4% on 24 February when Russia invaded Ukraine.

Many investors may have been tempted to sell, seeing it as the start of a long-term market decline. However, the very next day, the FTSE 100 recovered nearly all the ground it lost.

There’s no such thing as a crystal ball

Even the most experienced fund managers, backed up with teams of researchers and analysts find it hard to beat the market.

So how will an amateur stock-picker working on his kitchen table fare any better?

They might strike lucky once in a while. However, the Schroders research shows, doing nothing, remaining invested, and riding out a storm can be a more profitable long-term approach.

Let dividends work their magic

Another good reason for not over-managing your investments is the power of dividends.

Dividends are effectively a bonus paid to shareholders. Most are paid annually, although some blue-chip companies declare half-yearly or quarterly dividends.

One key thing to remember is that the value of dividends you receive is based on the number of shares you hold, rather than their value.

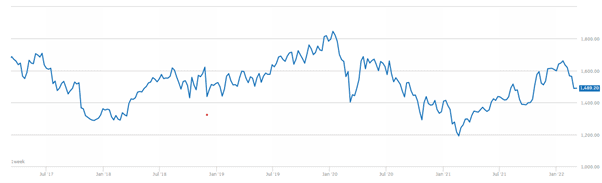

For example, this chart shows how the GlaxoSmithKline share price has fluctuated over the past five years.

Source: London Stock Exchange – GlaxoSmithKline (GSK) share price 10 March 2017 to 8 March 2022.

Yet, despite the fluctuation in the share price that you can clearly see in the chart, each quarter during this period they have paid a dividend of either 23p or 19p per share, regardless of the value.

So, if you hold GSK shares, or are invested in an accumulation fund of which GSK shares are a component, you would have benefited from a regular inflow of dividends.

The second key thing to consider with dividends is reinvesting the proceeds to buy more shares, unless you’re specifically using dividends as part of an income strategy.

Reinvesting dividends means you increase the number of shares you hold. So, in future years, you’ll get a potential dividend on more shares each time one is declared.

Sometimes doing nothing can feel counterintuitive, but may be the sensible option

When the Covid pandemic hit in March 2020, all major investment markets around the world fell sharply.

To an extent, the panic seemed understandable. This was a global pandemic for which – at the time – there was no vaccine.

As with many market downturns, an initial fall built up momentum as many investors saw the way prices were going, so decided to sell themselves.

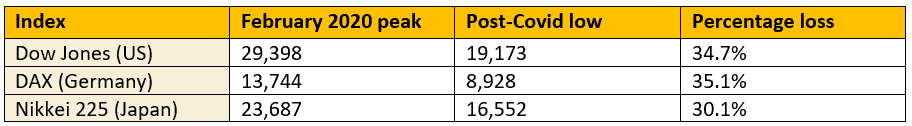

The table below shows how the scale of the panic affected three of the world’s leading markets.

Sources: Dow Jones, DAX and Nikkei, all via Google Finance.

Yet, by the beginning of 2021, all three indices had recovered their lost ground, and have subsequently shown further growth as the post-pandemic recovery has continued.

The sensible response to the Covid crash was to do nothing, even though all your instincts – driven by media comment and peer pressure – might have been to follow the herd and join in the selling frenzy.

Get in touch

If you would like to talk to us about your investments, and any concerns you may have, we are happy to help.

You can email us at enquiries@blackswanfp.co.uk or contact your adviser on 020 3828 8100.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The value of investments and income from them may go down. You may not get back the original amount invested. Past performance is not indicative of future performance.

Production

Production