Why you should overpay your mortgage with pandemic savings

Posted onThe pandemic has meant some families have been able to save more. Those that have continued to work during the last year are often finding their outgoings have been lower and they now have more cash put to one side. If you still have a mortgage, overpaying is one option worth considering.

According to research in FT Adviser, more than six million people have found it easier to save than normal during the pandemic. Workers may have saved more by cutting out the commute, and, of course, social opportunities have been far fewer during lockdown. While workers may have indulged in more treats at home, many have been building up their savings too. Dubbed “accidental savers”, it’s time to think how they can get the most out of their cash.

While it’s likely many savers are building up a nest egg in a cash account, would overpaying their mortgage be a better use of their savings?

How overpaying your mortgage can save you huge amounts

Interest rates are low. Money sat in a cash account, even an ISA, is likely to be earning little in terms of interest. While the money isn’t going anywhere in a cash account, the value of savings will be depreciating in real terms due to inflation.

Low-interest rates mean borrowing to buy a house is cheaper than ever. However, the interest you pay on a mortgage is likely to be significantly higher than you’ll earn with a savings account. Overpaying your mortgage can mean you save more in the long run.

Regular mortgage payments will usually pay off the interest accrued, plus a portion of the debt. When you overpay, the full amount goes towards reducing the amount borrowed. So, in the long run, overpaying mean you pay less interest and could be mortgage-free sooner.

Let’s say you have a mortgage of £200,000 that you’re paying over 25 years with an interest rate of 2.7%. Rather than keeping savings in cash, you make a one-off mortgage payment of £10,000. You’d save £9,131 in interest alone and be debt-free one year and eight months earlier.

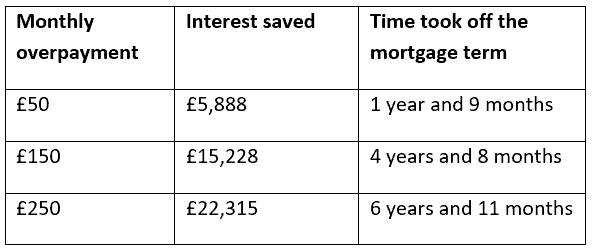

Making small regular overpayments can also deliver significant savings in the long run. In the above scenario, your normal mortgage repayment would be £917 per month. The below table highlights how overpayments add up.

Source: Money Saving Expert

If you have the means to do so, overpaying your mortgage can make financial sense. It also puts you in a position to pay off your mortgage sooner, significantly reducing your outgoings and leaving you with more disposable income in the future.

Households overpaid £5 billion of mortgage debt at the end of 2020

Overpaying a mortgage is something thousands of homeowners have been doing in the last year. In fact, between October and December 2020 alone, more than £5 billion was overpaid in mortgage debt, according to the Equity Release Council. The figure represented an 18% increase when compared to the same period last year and the highest value of lump sum repayments since 2007.

Taking advantage of circumstances that mean you have more to save now can create stronger financial security in the future. If you have the money in the bank to do so, it’s well worth considering joining the thousands of homeowners that have already overpaid their mortgage.

2 questions to answer before overpaying your mortgage

- Do you have an emergency fund? It’s important to build a financial safety net, so if you have extra money this should be a priority. Ideally, you should have between three- and six-months’ worth of outgoings accessible to ensure you can meet essential financial commitments if your income were to stop.

- Will you face any charges? Make sure you read the terms of your mortgage carefully, as you could face charges when overpaying. In most cases, you can overpay by up to 10% of the outstanding loan each year without penalty, but always check.

If you want help understanding your mortgage or need a new mortgage that will provide flexibility, please contact our team.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Production

Production