3 good reasons to increase your pension contributions (that have nothing to do with tax)

Posted onThere are many reasons why you should make sure you’re maximising your pension contributions. The most obvious, of course, is to ensure that you can achieve the lifestyle you want when you decide to retire. The more you save, the better your chance of reaching your goals.

Investing in a pension also offers significant tax benefits. Tax relief on your contributions can be up to 45% if you’re an additional-rate taxpayer, and even non-taxpayers can benefit from basic-rate tax relief on their contributions.

Maximising your pension contributions can also have some lesser-known benefits you might not be aware of. Here are three.

1. It can help you to increase your Child Benefit

Child Benefit isn’t means tested and is paid tax-free to most people with children. However, if you or your partner earns more than £50,000 a year and received Child Benefit, an Income Tax charge applies.

You can still claim Child Benefit in full, but HMRC will apply a tax charge on any partner whose income is more than £50,000 a year. If both partners earn more than £50,000, the charge applies to the partner with the highest income.

If your income is between £50,000 and £60,000 then the tax charge is a proportion of the Child Benefit received. If your income is over £60,000 then the tax charge wipes out your Child Benefit entirely.

When calculating the charge, HMRC use ‘adjusted net income’ to determine whether you or your partner earns more than £50,000.

Any pension contributions you make, whether gross contributions to an occupational pension scheme or gross contributions to a personal pension, will reduce the final amount of your adjusted net income.

If these contributions are enough to reduce your ‘adjusted net income’ to below £50,000, you’ll avoid the Income Tax charge. If your adjusted net income ends up between £50,000 and £60,000, the charge will be reduced.

So, by making pension contributions, you can reduce their adjusted net income and you may be able to gain back some or all of your Child Benefit.

2. You could increase your Personal Allowance

Your Personal Allowance is the amount you can earn before you start to pay Income Tax. It is £12,500 in the 2020/21 tax year.

If your income is more than £100,000 then you will lose some of your Personal Allowance. This is because your Personal Allowance reduces by £1 for every £2 of income you earn over £100,000. If you earn more than £125,000, your Personal Allowance will be nil.

What this means is that the effective tax rate for income between £100,000 and £125,000 is 60%.

As with the Child Benefit example above, the income used by HMRC to calculate the charge is ‘adjusted net income.’

So, if you make pension contributions you can reduce your ‘adjusted net income’ and regain some of your Personal Allowance.

If you choose to make pension contributions through salary sacrifice – your employer contributes to your pension in lieu of some salary – then the benefits can be even greater as both you and your employer will make National Insurance savings.

3. You could reduce your Annual Allowance taper

In the 2020/21 tax year, individuals can make pension contributions of up to 100% of their earnings or £40,000, whichever is the lower, and benefit from tax relief.

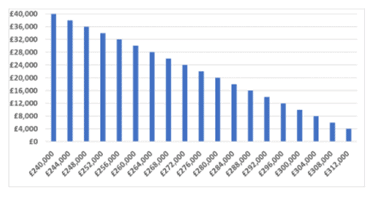

If your ‘threshold income’ is more than £200,000 and your ‘adjusted income’ is more than £240,000 then your Annual Allowance is reduced by £1 for every £2 of income above £240,000. If you earn more than £312,000, your Annual Allowance will be just £4,000.

Source: Prudential

Both measurements of income include all taxable income – so not just earnings. Investment income of all types and benefits in kind, such as medical insurance premiums paid by the employer, will also be included.

The difference is that ‘adjusted income’ includes all pension contributions (including any employer contributions), while ‘threshold income’ excludes pension contributions.

It follows that, if you increase your pension contributions, you will reduce your ‘threshold income.’ If you are able to reduce your threshold income to below £200,000 (in the 2020/21 tax year), the taper will not apply, and you’ll retain your full Annual Allowance of £40,000.

Get in touch

Working with a financial planner can help you to maximise your pension contributions and avoid receiving an unexpected tax bill. To find out how we can help, email enquiries@blackswanfp.co.uk or contact your adviser on 020 3828 8100.

Please note

A pension is a long-term investment. The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Your pension income could also be affected by the interest rates at the time you take your benefits. The tax implications of pension withdrawals will be based on your individual circumstances, tax legislation and regulation which are subject to change in the future.

Production

Production