3 practical ways to boost your savings in 2023 (and 3 challenges to try)

Posted onThe start of a year is a great time to commit to creating new habits for the months ahead. Whether you want to lose weight, take more exercise, or learn a new skill, January is a good time for a reset.

If you want to take control of your finances in 2023, boosting your savings might be a good place to start. It’s an ideal time to set some goals for the year ahead, and to create new habits that can improve your financial security.

To help you, here are three practical ways to boost your savings in 2023, and three “challenges” you can try to make saving less of a chore in the months ahead.

1. Create stability first with an emergency fund

On the journey to reaching your financial goals, there are always likely to be bumps in the road.

When it comes to savings, there are many reasons why you might suddenly need to access some money at short notice. It might be a car breakdown, a leaky roof, a broken boiler or a short period out of work.

Having an emergency fund in place gives you the reassurance that you will always have money available in a pinch. It means you don’t have to stop your regular saving, or dip into money you have accumulated for another purpose – potentially knocking your plans off course.

Experts normally recommend holding three- to six-months’ expenses in an easy access savings account. If you’re self-employed or work in a volatile industry, you might want even more.

Before you set any savings goals, make sure you have this safety net in place.

2. Set achievable goals

If you set yourself unachievable goals, it can be disheartening if you don’t reach them. You can become demotivated and, ultimately, give up.

So, if you want to boost your savings in 2023, make sure your goals are achievable. If you struggle to put aside £200 each month, don’t suddenly set yourself a target of saving £500 a month. Give yourself a goal that might stretch you, but you know you can achieve.

Some of the challenges later in this article might be a great place to start, particularly putting aside 1% of your earnings, and increasing this on a regular basis, or when you get a pay rise or a bonus.

3. Think about what you are saving for

Research has found that those people who think more about their “future self” save more.

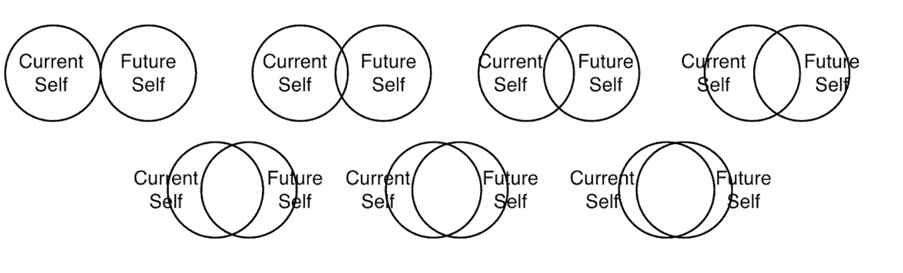

In the study, reported by the BBC, Hal Hershfield, associate professor of marketing, behavioural decision-making and psychology at the University of California, showed participants in his study a simple graphic that shows pairs of circles representing the current self, and a future self (see below).

The participants had to identify which pair of circles best described how similar and how connected they felt to their future self, 10 years from now.

From a financial planning perspective, those people who felt a greater connection to their future self – those who had clearer plans about what they wanted to do in a decade – had more savings than those who “lived in the now”.

It’s why we approach financial planning by thinking about what your goals are for the future. Encouraging you to think about what you are saving for, rather than just the purpose of “building up savings”, can make you more motivated and focus your mind on sticking to your savings plan.

3 challenges to help you to boost your savings in 2023

If you want to make saving less of a chore in 2023, here are three fun challenges that you can set yourself to keep you motivated throughout the year.

- Save a pound a day

This is as simple as it sounds. Here, you literally put aside a pound, every day. Put a pound coin in a jar or transfer £1 from your bank account to your savings each day and, by the end of the year, you’ll have £365 to show for it.

- Save 1% of your earnings

This challenge can help you to create a useful savings fund in the long term and, crucially, it ensures you save more when your earnings rise.

Calculate 1% of your monthly earnings (after deductions) and arrange a standing order for this amount into your savings. Make sure you “pay yourself first” by ensuring this money goes into your savings immediately you receive your earnings and then spend what is left.

Each time your earnings increase, change your standing order to reflect this. And, over time, try and incrementally increase the percentage you save.

- The 52-week challenge

At the end of week one of 2023, save £1. At the end of week two, make it £2. If you continue to increase the amount each week until week 52, your savings for the year should be £1,378.

Alternatively, try the “1p challenge”. On 1 January 2023, put a penny into your savings. On 2 January, put 2p aside. On 3 January, put 3p aside – and so on, every day, for the entire year. If you do this, by the end of the year you should have £667.95 in your savings account.

Get in touch

If you want to take control of your finances in 2023, or set savings goals that you can achieve, we can help.

To find out more, please email us at enquiries@blackswanfp.co.uk or call 020 3828 8100 today.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Production

Production