4 million people in lower-risk pensions could face a retirement shortfall

Posted onHow much risk are you taking with your pension savings?

A generation ago, many people approaching retirement would de-risk their pension savings. So-called “lifestyling” was commonplace as savers locked in the value of their fund as their retirement approached.

These days, many experts encourage pension savers – particularly those with a longer time to retirement – to consider taking more risk with their funds.

New research has found that as many as 4 million pension savers might be taking too little risk with their money, meaning that they could face a shortfall in retirement as they haven’t given their pot the maximum opportunity to grow. Read on to find out more.

More than half of under-40s think a “medium risk” approach will generate the strongest returns

New research from Opinium has found that two-thirds of people aged between 18 and 39 – around 10 million people – say they have a low-risk (25%) or medium-risk (41%) pension. Just one in five (19%) say their pension is high risk.

Despite evidence that a higher-risk portfolio – namely with a higher exposure to equities – is likely to deliver higher growth, more than half (54%) of workers under the age of 40 think a medium-risk pension will produce the strongest returns.

Just 20% of workers under the age of 40 thought that a higher-risk pension was the most appropriate level for their age.

There was also a gender divide between the approach to risk. Opinium found that nearly half (49%) of men say they have a medium appetite for risk compared with 33% of women, while 43% of women said their risk appetite was low, compared with 23% of men.

This suggests that women are prepared to take less investment risk, which could leave them with a lower pension fund than their male counterparts, further widening the gender pension gap.

Long-term investing increases your chances of returns

Younger savers often have decades of growth potential until their retirement. In this instance, considering a higher exposure to equities is likely to give their pension savings the best growth potential.

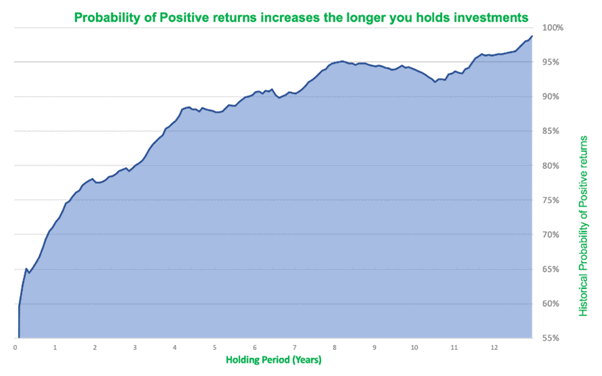

Research from Nutmeg in 2020 considered global stock market data between January 1971 and May 2020 and concluded that long-term investing dramatically increases your chances of returns.

Investing for any one-year period between 1971 and 2020 would have generated a positive return 71.8% of the time, while investing for 10 years increased your chances to 93.9%.

The research found that, if you had invested in the stock market for more than 13 and a half years at any point during this period, you would never have lost money.

The chart below shows the historical probability of positive stock market returns based on the period you held investments between 1971 and 2020.

Source: Nutmeg

Taking too little risk could leave you short in retirement

Becky O’Connor, head of pensions and savings at interactive investor, who commissioned the research, said: “It’s high time for some serious education around risk and growth in pensions for workers under 40, because at the moment, millions of people who are young enough to take some risk with their investment in return for higher growth are not doing so.”

Taking too little risk with your pension savings could leave you with a shortfall when it comes to your retirement. And this issue has been exacerbated in recent years thanks to low interest rates and bond yields.

Recent research from LCP found that a 22-year-old worker today would need to save 50% more to achieve the same pension pot as a worker who started work a decade ago. A worker now would need to contribute around 12% of their earnings to their pension, compared to a saver 10 years ago putting aside the current auto-enrolment minimum of 8%.

Working with a financial planner can ensure you’re taking the right amount of risk

A landmark study by the International Longevity Centre (ILC) in 2019 found that working with a financial planner can boost your retirement wealth.

The ILC found that receiving professional financial advice between 2001 and 2006 resulted in a total boost to wealth (in pensions and financial assets) of £47,706 in 2014/16. This was partly because financial planners typically encouraged clients to hold more assets in equity-based investments, in line with their personal tolerance for risk.

The evidence also suggested that fostering an ongoing relationship with a financial adviser leads to better financial outcomes. Those clients who reported receiving advice at both time points in the analysis had nearly 50% higher average pension wealth than those only advised at the start.

Get in touch

Ensuring you take the right amount of risk with your pension can ensure you save enough to fund your desired retirement lifestyle. To find out how we can help, please get in touch. Email enquiries@blackswanfp.co.uk or contact your adviser on 020 3828 8100.

Production

Production