5 important lessons you can learn from Warren Buffett about investing in volatile times

Posted onWith a net worth of more than $98 billion (around £81 billion), Berkshire Hathaway CEO Warren Buffett is one of the world’s most successful investors. According to Bloomberg, he’s also the seventh richest person in the world.

Over the years, the “Oracle of Omaha” has generated significant profits from his investments. Of course, he’s also been through tough times – indeed Berkshire Hathaway has seen its value fall by more than 30% six times between 1979 and 2019. In early 2000, Berkshire even lost 44%.

2022 has been a tough year for investors, with supply chain issues and the war in Ukraine pushing up prices and creating volatility. So, as someone who has invested in difficult times, Buffett is well placed to share his wisdom.

Here are five valuable lessons we can learn from his experiences.

1. Be greedy when others are fearful

In one of his most famous quotes, Buffett urges us to “be greedy when others are fearful, and fearful when others are greedy”.

When investors get carried away and share prices rise and rise, prices can increase to unsustainable levels. The dot-com bubble of the late 1990s is a great example of this. At these times, Buffett counsels investors to “be fearful”.

Conversely, when share prices are falling it can often provide opportunities to buy shares or fund units at a discounted price. Purchasing more shares or units can then help you to boost your returns when markets recover – as, historically, they invariably have.

You should remember that even seasoned fund managers can’t predict the top and bottom of the market. It’s likely that, if you invest when share prices are falling, you will at first sustain some losses that will test your resolve.

However, with a long enough time horizon, you should expect to see positive results.

2. Temperament, not intellect

When it comes to investing, it’s easy for emotions to take over. So, trust Buffett when he says: “The most important quality for an investor is temperament, not intellect.”

You have previously read about five behavioural biases that can lead to investment mistakes. From focusing on losses to following the crowd, it’s easy for you to be guided by your emotions and to make knee-jerk decisions that could damage your progress towards your long-term goals.

This is where working with a financial planner can really help. We can be a sounding board and help you make rational decisions during periods of volatility.

3. Successful investing takes time, discipline, and patience

Investing is not about generating immediate returns. As Nobel prize-winning American economist Paul Samuelson once said: “Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.”

Buffett takes a similar view, arguing “successful investing takes time, discipline, and patience”.

Your investment time frame is likely to be years or even decades, and so it’s vital to focus on your long-term goals rather than short-term market movements.

In a time where markets are uncertain, remember that if your financial plan and goals haven’t changed, neither should your plan.

No matter how great the effort, some things just take time. As Buffett also famously said: “You can’t produce a baby in one month by getting nine women pregnant.”

4. If you don’t feel comfortable owning a stock for 10 years, you shouldn’t own it for 10 minutes

If you’re researching where to invest, Buffett has simple advice. He seeks companies that he calls “inevitables” – those that have demonstrated longevity and dominant market positions, allowing them to generate attractive returns for shareholders year after year.

These are businesses with solid financials – a strong balance sheet, good profits, and manageable levels of debt. This is even more important in an environment where interest rates – and consequently the cost of debt – is increasing.

If you’re not sure, seek advice from a professional who can help you build a well-diversified portfolio that aligns with your tolerance for risk.

5. Don’t get too comfortable holding cash

In October 2008, Buffett wrote an op-ed titled Buy America, I Am where he talked about the danger of being too comfortable holding cash.

He said: “Today people who hold cash equivalents feel comfortable. They shouldn’t. They have opted for a terrible long-term asset, one that pays virtually nothing and is certain to depreciate in value.”

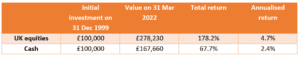

The data bears out Buffett’s sentiments. The table below compares the returns of investing in the UK stock market (as represented by the FTSE All Share Index) with dividends reinvested and the returns of investing in cash deposits with interest reinvested from the beginning of 2000 to 31 March 2022.

Source: FE fundinfo. Data as at 31 March 2022. Past performance is not a guide to future returns.

You should remember that this period includes the three times where share prices fell sharply. Following the bursting of the dot-com bubble in 2000, UK equities fell by 48% between September 2000 and March 2003. Similarly, UK equities fell by 46% between October 2007 and March 2009 in the financial crisis and by more than 20% during the first Covid lockdown in March 2020.

Despite these declines, equities have still outperformed cash deposits by more than 100% since the beginning of the century.

So, if you’re investing with a time frame of more than five years, it could pay to heed Buffett’s advice and consider equities rather than cash.

Get in touch

If you’d like to review your portfolio during these difficult times, please get in touch. Email us at enquiries@blackswanfp.co.uk or contact your adviser on 020 3828 8100.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

Production

Production