What VE day and its aftermath can tell us about where taxes are going post-pandemic

Posted onFor the first time in 25 years, the May Bank Holiday has been moved this weekend in order for the nation to commemorate the 75th anniversary of VE Day.

VE Day, or Victory in Europe Day, marks the day towards the end of World War II when fighting against Nazi Germany came to an end in Europe.

Sir Andrew Gregory, chief executive of SSAFA, the Armed Forces charity, says: “It is our duty to keep the events of the past alive in collective memory, including future generations – this is how we ensure that such a conflict never happens again.

“It is our hope that the nation takes a moment to reflect on the significance of this date, as a milestone that changed the course of history for the whole world.”

Just two weeks after VE Day, the UK went to the polls in a General Election that unexpectedly returned a landslide Labour government. One of the first challenges the new administration faced was the huge public debt that had been generated during the wartime effort and how best to increase tax revenues to plug this gap.

There are many economic parallels between the aftermath of World War II and the likely consequences of the coronavirus pandemic. In both cases, there is a huge government debt to repay, and both situations highlight the challenges of regaining control of the public finances without penalising those (often working-class) people who were at the front line of the efforts.

So, what can the economy after VE day tell us about what might happen once the pandemic is over?

Huge public debt could see Income Tax rises

During World War II, the government was forced to borrow heavily in order to finance the war effort. By the end of the conflict, Britain’s debt exceeded 200% of GDP, and it took until 2006 for the UK to repay the last of its war loans to the US.

In recent weeks, the government has committed to unprecedented levels of borrowing to navigate the country through the coronavirus crisis. There are plans to borrow £225 billion from the bond markets in just four months to fund the huge increase in public spending as the Treasury props up businesses and personal finances.

Just as after 1945, British taxpayers could be facing significant increases in taxes to repay this eye-watering debt.

Mel Stride, the Conservative MP who chairs the Commons Treasury committee said: “There will be very difficult choices, therefore, around spending on the one hand and taxation on the other.

“I think in the taxation debate there will be a very important debate to be had about who should bear the heaviest levels of additional taxation, especially when you think it is the lowest paid and often the youngest people who have been most impacted.”

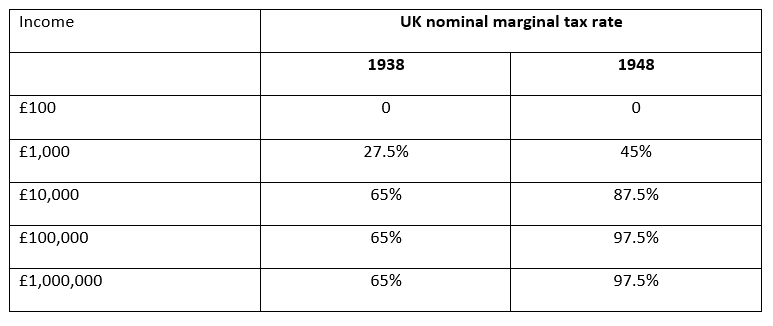

Studies have found that British top marginal Income Tax rates ‘skyrocketed’ during the two World Wars up to an unprecedented 97.5% during World War II, as this table shows:

Source: https://www.ehs.org.uk/dotAsset/8706c2fa-8c55-4d40-bfa5-75177223df68.pdf

So, could we see increases to Income Tax – particularly for the better off – after the pandemic ends?

The Chancellor has already hinted that taxes could rise. When announcing his package of measures to support the self-employed, Rishi Sunak suggested that these workers may pay more tax in future.

Sunak said: “If we all want to benefit equally from state support, we must all pay in equally in future. It is just an observation that there is currently an inconsistency in the tax treatment of the employed and self-employed”.

Increasing the top rate of Income Tax does have precedent in times of crisis and so the 45p top rate could be set to rise.

There could also be changes to reliefs and exemptions. Most of the £21.2 billion a year the government foregoes through pension tax relief is claimed by people earning more than £50,000 a year and so there could be changes to pension tax relief for higher earners.

In addition, Council Tax bands have not been revised in almost 30 years and so further property taxes could also raise revenue.

Inheritance Tax

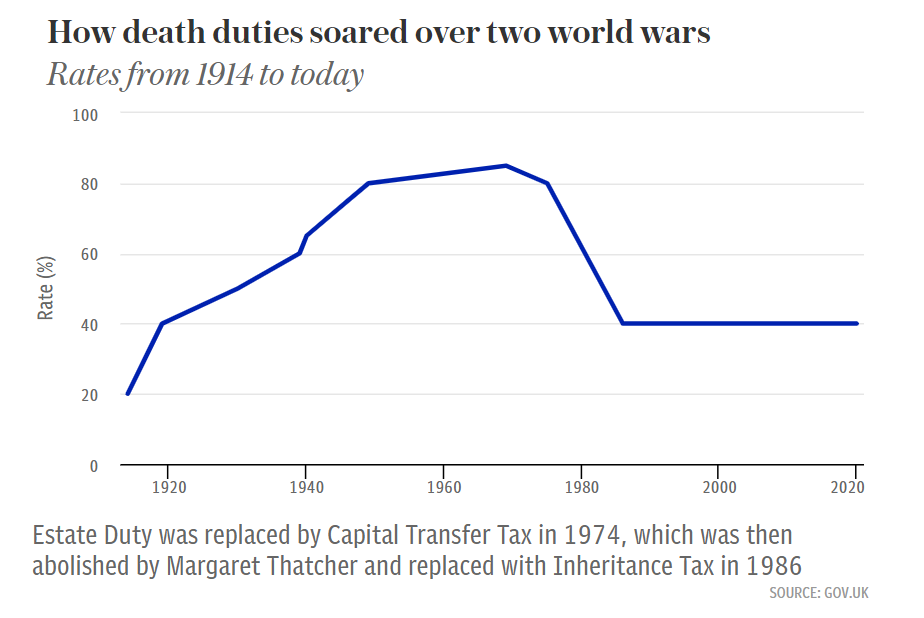

Another way the post-war government sought to increase tax revenue was to hike Inheritance Tax.

Then called ‘estate duty’, the rate was raised to 80% after the Second World War and reached a peak of 85% in 1969.

Source: Telegraph

Today, the Inheritance Tax rate stands at 40%. While there were rumours that the Chancellor might tweak the tax in his first Budget, no changes were made – although these reforms could be revived to raise much-needed cash.

The Chancellor has several choices:

- Increase the rate of Inheritance Tax payable

- Reduce the current thresholds

- Reform the current reliefs, perhaps abolishing the ‘seven-year rule’ or the ability to pass on unused pension assets tax-free.

Get in touch

Whatever the Chancellor decides, with a huge public debt to repay it’s reasonable to expect some changes to taxes during this parliament – whether they are on property, wealth, income or inheritances.

So, now could be the time to act in order to benefit from some of the reliefs and exemptions that are available. If you need any advice, please get in touch. Email enquiries@blackswanfp.co.uk or call 020 3828 8100.

Production

Production