What the change to the Retail Prices Index means for your pension

Posted onThe Treasury has recently confirmed that the Retail Prices Index (RPI) measure of inflation is set to be brought into line with the Consumer Price Index including Housing costs (CPIH) rate by 2030.

While the move may have positive benefits for the Treasury, it means that many people’s pension funds will grow at a slower rate, which will have an impact on millions of pensioners and investors.

If you want to know what this change will mean for your retirement, read on to find out how the change from RPI to CPIH will affect you.

RPI has been criticised for overestimating the cost of living

There are several methods that the government uses to measure inflation, but two of the most common are the RPI and CPIH.

While both measure inflation by tracking the price changes of a basket of 700 goods and services, the two rates differ because of the way in which the government measures them.

Essentially, CPIH is calculated by taking the households of high-earners and pensioners into account, whereas RPI does not. Since RPI is not representative of all UK households, this leads to criticisms that it overestimates the cost of living.

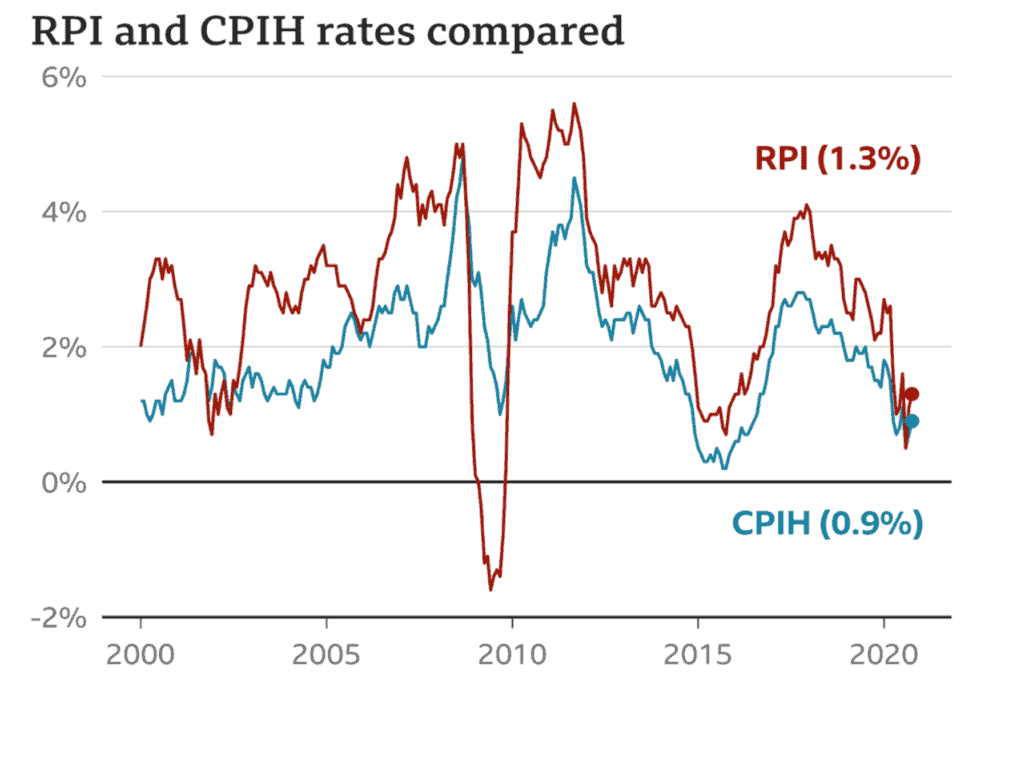

The move to CPIH is a controversial one as it is likely to have a negative impact on many people. Since the CPIH is typically lower than the RPI, as seen on the graph below, this change means that both pensioners and policyholders are likely to see a smaller annual increase in their benefits.

Source: BBC

The switch could cause pension holders to be worse off by as much as 9%

While public sector pensions are already linked to CPIH, when the change takes place in 2030 it will affect millions of people who hold private sector pensions.

Since the CPIH is typically around 1% lower than the RPI, it may mean that your pension grows at a slower rate than you may have expected.

Holders of Defined Benefit pension schemes will be particularly affected by these changes as typically the income that these schemes provide rises in line with the RPI.

A report by The Pensions and Lifetime Savings Association has calculated that, depending on their age, the average holder of a Defined Benefit pension scheme could be worse off by as much as 9% over the course of their lifetime. The change is expected to have a greater impact on women as they tend to have a higher life expectancy.

This change will have a significant impact, as an estimated 1.3 million people are actively contributing to a Defined Benefit pension schemes and a further 11.8 million may be able to claim one in future.

If you receive an income through an Annuity, you could also be affected by the change. If your Annuity is set to rise in line with inflation, it could grow at a slower rate.

While the difference between the RPI and the CPIH may seem not seem significant, generally being around 1% or smaller, it could have a sizeable effect in the long run.

Thomas Selby, from the investment firm AJ Bell, was quoted in the Guardian as saying that even though the difference between RPI and CPIH may seem small, over time “it could lead to a retirement income worth thousands of pounds less.”

According to a report published by the Association of British Insurers, published by FT Adviser, the change could wipe out as much as £96 billion worth of pension growth. Experts warn that this shortfall may require government intervention to resolve and could have a significant impact on many people’s retirement plans.

Government bonds will see reduced returns

While the government has not used RPI as an official national statistic since 2013, it still uses it when calculating the returns on government-issued bonds. This means that companies which invest in government debt linked to inflation, known as index-linked gilts, are also set to lose out from this change.

Since the gilts are linked to the RPI, if this is changed to CPIH instead, they will grow at a much slower rate than was predicted when investors bought them.

According to report from the Pensions and Lifetimes Savings Association, the switch to CPIH has the potential to reduce the value of these investments by as much as £60 billion.

To protect the interests of investors who bought the gilts in good faith, Chancellor Rishi Sunak has announced that the change to CPIH will occur in 2030, rather than 2025 as initially speculated. Current ten-year index-linked gilts will therefore have time to mature before the switch.

This measure will help to ensure that companies which invest in gilts will be able to do so with the knowledge that the change will occur in the future.

Get in touch

If you have any questions about what this change means for you, please get in touch. Email enquiries@blackswanfp.co.uk or contact your adviser on 020 3828 8100.

Please note

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The value of your investment (and any income from them) can go down as well as up which would have an impact on the level of pension benefits available.

Your pension income could also be affected by the interest rates at the time you take your benefits. The tax implications of pension withdrawals will be based on your individual circumstances. Levels, bases of and reliefs from taxation may change in subsequent Finance Acts.

Production

Production