Why Britain’s Covid savings boom could negatively affect your lifestyle in retirement

Posted onOver the last few months, the cost of living has remained pretty static. Despite worries that Brexit would drive up prices, the inflation rate in the UK has remained at below 1% for several months – until now.

Inflation more than doubled in April to 1.5% and many experts are concerned that the rate is set to rise even further in coming months.

While you may see the effects in short-term price rises, rising inflation also presents a serious risk to your lifestyle in later life. Read on to find out why.

Why is inflation set to rise?

A recent Bank of America survey, reported by Forbes, revealed that global investment managers are more worried about the risk of inflation on markets than they are about the risk of Covid-19.

There are similar worries in the UK. The Bank of England has said that it will “take whatever action was necessary” to combat inflation, which could mean raising interest rates.

One of the main reasons for concern is that UK households have saved about £160 billion over the past 14 months, according to the National Institute of Economic and Social Research (NIESR). The Bank of England’s chief economist, Andy Haldane, believes that as much as 20% of that could be spent before the end of the year, driving demand for goods and services.

Corporation Tax breaks announced in the Budget will also drive business investment.

If too much money is chasing too few goods – perhaps because of restricted imports due to the pandemic and Brexit – prices are likely to rise.

According to the Times, inflation will temporarily overshoot the Bank of England’s 2% target towards the end of 2021 but will settle back at about 2% over the coming years.

Why inflation is a risk to your future lifestyle

In simple terms, over time your money needs to increase in value by more than the rate of inflation. If it doesn’t, it will become worth less.

If you have £10,000 stashed under the mattress it will still be £10,000 in 30 years’ time. However, due to inflation, it will have a lot less purchasing power than it does today.

When you’re planning for your retirement, inflation becomes one of the most serious risks.

For example, even if inflation remained in line with the Bank of England’s 2% annual target, your money now will be worth a third less in 20 years’ time. It will be worth less than half of its current value after 40 years.

Of course, if inflation is higher then the impact will be even greater.

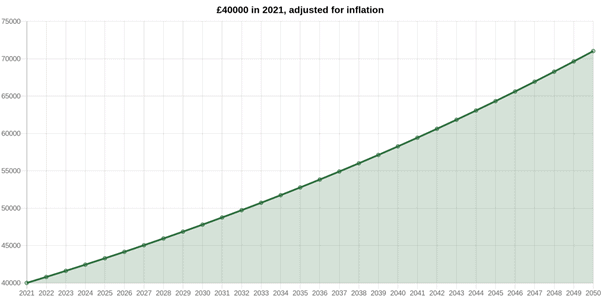

Say you want to retire on £40,000 in 10 years’ time. Assuming annual inflation of 2%, you’d need an income of £48,759 in a decade’s time.

If you were retiring in 20 years’ time, you’d need £59,437 to have the same purchasing power as £40,000 today.

Figures from online inflation calculator

What this means is that, when you’re working out how much you need to save for retirement, you need to take rises in the cost of living into account. If you’d carefully saved enough to generate an income of £40,000 every year, that would be fine in year one. However, from year two onwards your standard of living would fall because of rises in the cost of living.

As financial planners, we can use cashflow modelling to consider the effects of inflation when working out how much is “enough” for your retirement. We can make assumptions about investment growth and inflation to ensure that you can maintain your lifestyle in real terms – even if you live for 20, 30, or even 40 years after you retire.

We can also model different spending patterns in retirement. For example, many people lead a more active lifestyle in the early years of retirement and so need a higher annual income. Or, you may need to plan for care fees later in life.

Remember your State Pension is protected

It’s worth mentioning here that, under the present “triple lock” system, your State Pension will be protected against rises in the cost of living.

The triple lock currently ensures that the basic State Pension increases annually by the greater of:

- Inflation

- Average earnings

- 2.5%

Since its introduction in 2011, the State Pension has risen by the rate of price inflation on three occasions:

- By 5.2% in 2012/13

- By 2.7% in 2014/15

- By 3% in 2018/19

Assuming the triple lock remains, it will protect the value of your State Pension even if inflation were to rise in the future.

Get in touch

If you’d like to discuss your retirement savings, or what rising inflation might mean for you, please get in touch. Email enquiries@blackswanfp.co.uk or contact your adviser on 020 3828 8100.

Production

Production