Equity release: Here’s why the right to make repayments could cut the cost of borrowing

Posted onEquity release can help boost your finances later in life. The way that interest is rolled up often means that people ended up with high levels of debt, but the new right to repayment could change that.

Equity release allows you to access some of the wealth that’s tied up in your property, most commonly through a lifetime mortgage. As property prices have soared and are often among your most valuable assets, it can be a useful way to increase your income or access a lump sum.

Traditionally, if you took out a lifetime mortgage, you’d receive a lump sum, and you wouldn’t make any repayments. Instead, the interest accrued would be rolled up and paid once you passed away or moved into long-term care.

While this is beneficial for some people, it means the total amount of debt can quickly increase and you may not have any property wealth to leave behind for loved ones.

In recent years, new measures have made equity release more attractive for consumers. For example, a negative equity guarantee means the amount you owe cannot exceed the value of the property, ensuring other assets remain intact. Or some providers may allow you to ringfence a proportion of your property wealth to pass on to children.

Now, the right to make repayments could provide older homeowners with even more flexibility.

What does the “right to repayment” mean?

Equity release customers taking out a lifetime mortgage from a provider that meets the Equity Release Council standards from 28 March 2022 will be guaranteed the right to make penalty-free partial repayments of their loans.

As a result, new customers will be able to offset the interest the debt is accruing and reduce their borrowing if they wish to.

David Burrowes, chairman of the Equity Release Council, said: “As recent years have reminded us, people’s circumstances can change and customers who find they can use earnings, savings or an inheritance to reduce their borrowing later in life will be able to do so without incurring early repayment charges.”

Rolling up interest can drastically increase how much you owe during your lifetime

One of the drawbacks of equity release is that you can end up owing far more than you originally borrowed because of the way that interest is rolled up.

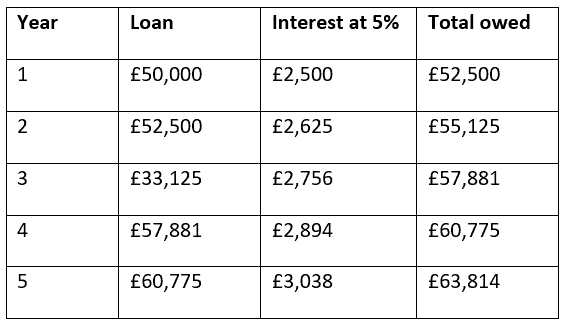

The below table shows how interest adds up if repayments aren’t being made on an equity release loan of £50,000 that has an interest rate of 5%.

Source: Equity Release Council

As the interest is added to the loan amount each year, you go on to pay interest on the interest that has previously been rolled up. As a result, the longer you have a lifetime mortgage, the quicker the total amount owed will rise.

So, the new guarantee can mean you’re able to unlock property wealth while better managing the loan taken out against your home and reducing the interest.

One thing to consider is affordability and your ability to make repayments if that’s your plan. If you had to stop making repayments because your circumstances have changed, it’s important to understand how this would affect your borrowing and the inheritance you leave for your family.

If you’re thinking about using equity release and would like to make repayments, you should carefully check if this is an option, not all providers meet the standards set out by the Equity Release Council.

Is equity release right for me?

Equity release can be a useful way to boost your finances in retirement, but it’s not the right option for everyone.

You will usually need to be age 55 or older and own your own home to be able to use equity release to unlock property wealth.

You should also consider how it fits into your overall plan and what your alternative options are. In some cases, depleting other assets you may hold, such as savings or investments, or downsizing makes more sense for your goals, so it’s important that these are weighed up alongside equity release.

Choosing to use equity release can also limit your other options. For instance, you won’t be able to take out another loan against your home and it can make it more difficult and costly to move. It could affect some means-tested benefits too.

If you have any questions about equity release and want to understand if it’s an option you could benefit from, please contact us.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Equity Release will reduce the value of your estate and can affect your eligibility for means-tested benefits.

Production

Production