As bitcoin heads towards the mainstream, here’s why cryptocurrency is risky

Posted onIf you’ve been on any social media over the last year, it’s been almost impossible to ignore the noise around cryptocurrencies.

Recent research from the Financial Conduct Authority (FCA) revealed that public awareness of currencies such as bitcoin and ether has risen in the last 12 months, with 78% of adults having heard of cryptocurrencies. The FCA estimates that 2.3 million people own cryptocurrency now, up from 1.9 million in 2020.

As well-known personalities such as American entrepreneur Elon Musk bring bitcoin into the mainstream, it’s important to remember that it’s a risky way of investing, and that it’s not something a financial adviser would recommend.

More people see cryptocurrencies as a genuine asset class

According to FCA research, median holdings in cryptocurrency have risen (up from £260 to £300) in a strong period of price increases.

While the profile of cryptocurrency owners has not changed substantially – the population remains skewed towards men who are over 35 and are from the AB social grade – attitudes towards crypto have changed in recent years:

- Fewer crypto users regard them as a gamble (just 38%, down from 47%).

- More investors are seeing crypto as an alternative or complement to mainstream investments.

- Half of crypto users say they intend to invest more.

However, one of the FCA’s major concerns is that the level of understanding of cryptocurrencies is declining, suggesting that some crypto users may not fully understand what they are buying.

Crypto as the latest in hundreds of years of “manias”

History can teach us much about investing trends. A concern for many experts is that cryptocurrency is just the latest in a series of “bubbles” that date back to the 17th century.

Back in 1636 the Dutch Republic had some of the most sophisticated financial institutions in Europe, including the first official stock exchange, capital market, and central bank. One of the main innovations of this financial system was the formal trading of futures.

When merchants began trading futures of tulip bulbs – a luxury commodity at the time – a bubble quickly began to form. At the height of the mania, futures contracts for tulips could change hands as many as 10 times per day. Prices rose to several dozen times their intrinsic price.

Of course, when the bubble popped, the price collapsed overnight, and many investors lost everything.

There are similarities with this and other manias – such as “railway mania” in 19th century Britain and the dotcom bubble of the late 1990s:

- Manias are fuelled by stories of people that have made huge sums of money. These stories tend to draw more people in until the mania collapses under its own weight.

- The potential for wealth can lead to poor moral behaviour.

- Investors often ignore the true underlying value of an investment. Were tulips really worth the amount they were trading for at the peak?

- There can be a phenomenon called “escalating commitment”. This is where enthusiasts become increasingly committed to a belief following setbacks, resulting in increasing investment and subsequent greater losses as the eventual outcome becomes inescapable.

Of course, manias can result in a few investors making significant financial gains. Some will have made a substantial sum by trading bitcoin, just as some 18th century industrialists became very rich by building railways.

Why crypto is a risky investment

According to the FCA, the most popular reason for consumers buying cryptocurrencies is “as a gamble that could make or lose money”.

So, on the face of it, most people still believe that buying crypto is a “gamble” rather than part of a long-term investment strategy. Your financial planner would never advise you to invest your money in the Grand National or on the turn of a card!

One of the reasons you may be attracted to cryptocurrency is the promise of strong returns. Over the last few years, cryptocurrencies such as bitcoin have sometimes provided high, if volatile, returns.

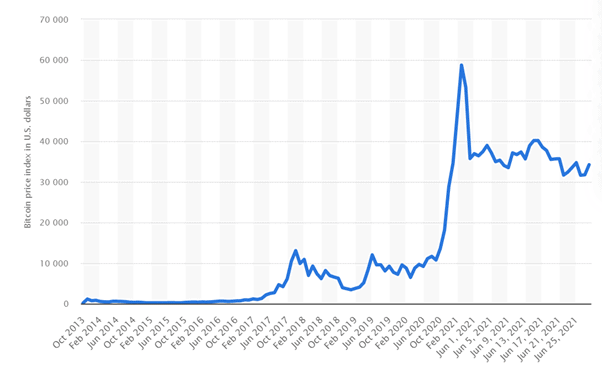

This graph shows the value of bitcoin in US dollars since 2013.

Source: Statista

As you can see from this chart, had you bought bitcoin in 2015 and sold at the peak in February 2021 you’d have made significant gains.

However, had you bought approaching the peak, the value of your holding would have fallen by almost half in just a few months.

It’s this volatility that can make cryptocurrency such an unpredictable investment. It’s perhaps no surprise that 29% of crypto owners now check the value of their holdings every day!

The key is to be extremely cautious.

In 2021, many investors moved significant amounts of their savings into crypto as the market boomed. Of course, when the bubble burst, the value of these assets fell sharply. The value of bitcoin fell from almost $57,000 on 12 May 2021 to less than $35,000 just 12 days later.

Cryptocurrency fund manager, Jacob Eliosoff, told Forbes: “Never put more into crypto than you can afford to lose. This is still all very risky. If you can’t laugh wryly and move on if it goes to $0, you should never have gotten in.”

Remember also that just because crypto is new and interesting doesn’t mean you have to invest — people have been successfully saving and investing for retirement for decades without bitcoin.

Get in touch

If it’s time for your financial review, or you want to explore how we can help you in this uncertain time, please get in touch. Email enquiries@blackswanfp.co.uk or contact your adviser on 020 3828 8100.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Production

Production