How the “rule of 72” can help you to see how quickly you can double your money

Posted onIf you were to invest £1,000, how quickly do you think you could realistically double your money?

Of course, you could head down to your local casino, pop it all on red, and double your money in the spin of a roulette wheel. Similarly, you could lose the £1,000 just as quickly.

If you have savings goals in mind and you want to get a ballpark figure of how quickly you can expect to double your wealth, there is a simple rule you can follow. Read on to find out more.

The “rule of 72” can help you to work out how quickly you might double your wealth

The “rule of 72” is a simple way that you can work out how quickly your savings might double in value, based on the expected rate of return.

The formula is:

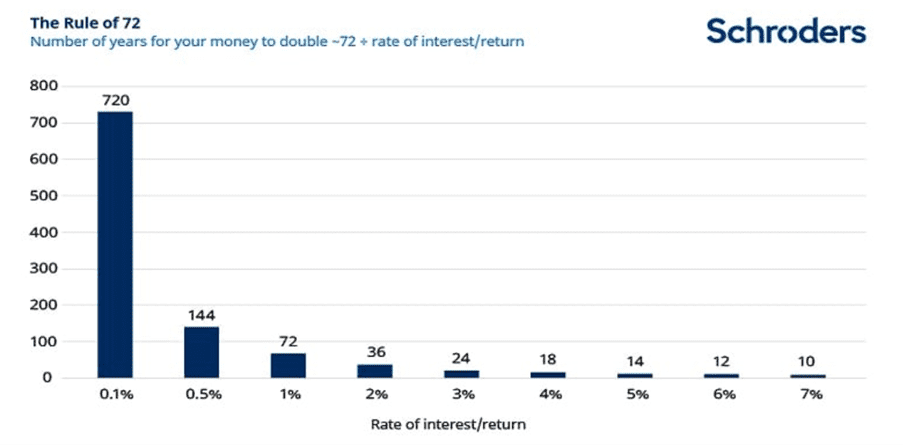

- Number of years = 72 ÷ rate of interest/return

So, if your money is in a fixed-interest account paying a guaranteed 3% each year, it would take 24 years for your cash to double in value.

- 24 years = 72 ÷ 3%

This is only an approximation but can be useful as a quick and easy way to get an idea of how your wealth will grow.

Research by MoneyAge reveals that more than half (50.2%) of easy access non-ISA savings accounts in the UK earn 0.5% or less.

If you were earning 0.5% on your money, it would take approximately 144 years for your cash to double in value. You’d likely not live to see this happen!

The chart below shows how long it would take to double your money based on different rates of return.

Source: Schroders. The chart is for illustrative purposes only. The “rule of 72” is only an approximation. Figures take no account of additional savings that an investor might make, or the impact of inflation.

Of course, these are only approximations, and investment returns can rarely be guaranteed. It does show, however, that being too cautious with your money could hinder your progress towards your long-term goals.

Investing can help propel you towards your long-term targets

When it comes to planning to meet long-term goals, the return you achieve on your wealth can help to determine whether you’ll have “enough” to reach them.

If you are too cautious when it comes to investing your wealth, it could well result in slower progress towards your targets.

For example, putting all your pension savings in an investment with a 3% return might be low-risk, but it will take you 24 years to double your money. If you are in your 50s or 60s, you may not have that time.

Compare this to investing in a well-diversified portfolio. If you could just achieve a little better annual return – say 5% rather than 3% – you would double your pension savings in just 14 years.

According to BlackRock, European shares returned an average of 5.5% a year between 2014 and 2023. US equities returned an average of 12.6% a year during the same period.

Compare this to cash, which returned 0.8% on average.

Of course, the value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

However, in the long term, investing can provide you with the potential for higher returns. According to the “rule of 72”, that means you could double your money in less time – helping you to meet your savings goals sooner.

Get in touch

If you’d like help in building a saving and investing portfolio that’s right for you, please get in touch. Email us at enquiries@blackswanfp.co.uk or call 020 3828 8100 today.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Production

Production