Why September’s inflation rate could deliver a bumper boost to your State Pension

Posted onFor months, you’ve probably heard about the cost of living crisis and how it means your budget needs to stretch further. However, if you collect the State Pension, the high rate of inflation could mean it increases by a record amount in the 2023/24 tax year.

The State Pension benefits from something known as the “triple lock”. This means that the amount you receive increases each tax year by one of the three measures below, whichever is higher:

- Average wage growth year-on-year for the May to July period

- Inflation as measured using the Consumer Price Index (CPI) in the year to September

- 2.5%

So, the State Pension increases by at least 2.5% each tax year. It’s designed to help preserve the spending power of pensioners as the cost of goods and services can change dramatically during your retirement.

The exception to the pension triple lock was the 2022/23 tax year. Under the triple lock, the State Pension would have increased by average wage growth, which was 8.8%. However, it was temporarily suspended, as the government said the Covid-19 pandemic and furlough had skewed the data.

While there have been some concerns that the government would suspend the triple lock again, as inflation is much higher than normal, it has been reinstated.

The largest triple lock increase to date was 5.2%

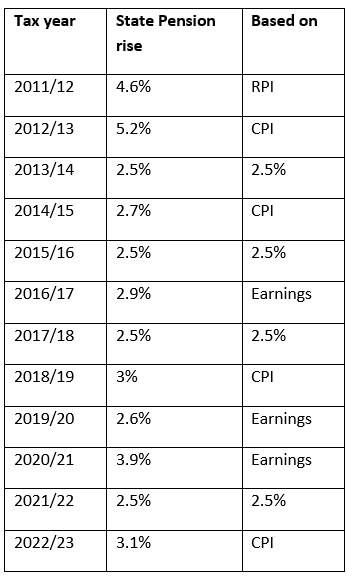

The government introduced the triple lock in the 2011/12 tax year, and, so far, the highest annual increase is 5.2%. The table below shows how the State Pension has increased each tax year.

The rise for the 2023/24 tax year is likely to be based on September’s inflation rate, and it could be significantly higher than the previous rises.

Several factors mean that inflation is at its highest level in 40 years. The lingering effects of the pandemic and lockdowns mean that some materials and goods are in short supply, which is pushing prices up. Coupled with this, the war in Ukraine is also affecting the global economy, especially food and energy prices.

This led to inflation of 10.1% in the 12 months to July 2022, according to the Office for National Statistics. The Bank of England (BoE) has said it expects inflation to hit 13%.

So, there’s a real chance that the September inflation rate, and triple lock increase, will be in double digits. For pensioners, that could mean a record boost to the income they receive from the State Pension.

How much you receive from the State Pension depends on your National Insurance record. Assuming you have 35 qualifying years of National Insurance contributions (NICs), you’re entitled to the full State Pension, which is £185.15 a week (£9,627.80 a year) in 2022/23.

As a result, a 10% increase to the State Pension would see an annual boost of more than £950 for those receiving the full amount.

If you have fewer than 35 years on your NICs record, you will receive a proportion of the State Pension. You will still benefit from the triple lock increase each tax year.

Bear in mind that you’ll usually need at least 10 qualifying years on your NICs record to get any State Pension.

How the triple lock helps you maintain your lifestyle in retirement

The triple lock is one of the key reasons why the State Pension is an important part of your retirement plan.

Even when inflation is relatively low, it affects your spending power. Over the decades you could spend in retirement, this adds up. An income that afforded you a comfortable lifestyle at the start of retirement may not stretch as far in your later years.

Let’s say you retired in 2001 with an income of £20,000 a year. Over the next 20 years, inflation averaged 2.1%, according to the BoE’s inflation calculator. To simply maintain your spending power, you’d need an income of more than £30,000 by 2021.

Now imagine the effect that higher rates of inflation, like those we’re experiencing now, could have on your outgoings.

If you don’t consider inflation when planning for your retirement, you could face challenges in your later years.

The triple lock means you have a reliable base income that will increase each tax year.

You should also consider how inflation may affect your other sources of income and what steps you can take to maintain your spending power.

Investing a proportion of your wealth can mean the value of your assets continues to grow throughout retirement. It may allow you to take a greater income in the future, although investment returns cannot be guaranteed.

Alternatively, you may choose to purchase an annuity, which would deliver an income for the rest of your life. The income paid by some annuities will rise each year in line with inflation.

There are often many options you can weigh up to make inflation part of your long-term retirement plan. If you have questions about the steps you could take or would like to review your current plan, please contact us.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future results.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts.

Production

Production