Good Money Week: ESG and investment sustainability

Posted onDo you consider sustainability when making financial decisions? With Good Money Week starting on the 24th October, which aims to encourage people to think about sustainability when it comes to banking, pensions, savings and investments, now is a good time to learn more.

While sustainability in finance is often associated with incorporating ethics and values, it can help improve your long-term outcomes too.

What is ESG?

ESG stands for environmental, social and governance.

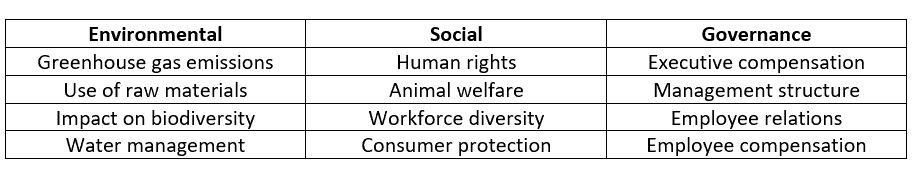

These are the three core pillars that are considered when weighing up whether a company is considered sustainable. All three categories can cover a broad range of areas. The table below highlights some of the things an ESG investor may consider.

ESG investing means you take some of these factors into consideration when deciding where to invest. Rather than simply looking at the financial side of the business, you’d consider how the business operates and its place in the world. This doesn’t mean the financial performance of a firm is discounted, that’s still an important part of assessing an investment even when ESG is playing a role.

For investors that want to incorporate their value into decisions, ESG investing can help. For instance, those that are concerned about climate change may choose to omit fossil fuel companies from their portfolio.

However, ESG can add value to your long-term goals too.

Sustainability and investment performance

When we’re investing, it should be with a long-term goal in mind. As a result, sustainable firms, which should also consider long-term impacts, can help a portfolio to deliver returns.

Research published in the Financial Times found close to six in ten sustainable funds delivered higher returns than equivalent conventional funds over the last decade. The research looked at 745 Europe-based sustainable funds and found that the majority of strategies have done better than non-ESG funds over one, three, five and ten years.

Sustainable funds’ rates of success varied depending on the asset class. For instance, more than 80% of US large-cap blend equity funds beat their traditional peers over ten years. It was also found that sustainable funds have a greater survivorship rate than non-ESG options. On average, 77% of ESG funds that were available ten years ago still exist. For traditional funds, the figure was just 46%.

Despite ESG values often being associated with lower returns, the findings demonstrate they can add value to investment portfolios.

A survey from Schroders found this is increasingly being reflected in investors’ beliefs too. When asked if sustainable investments are attractive, 42% said ‘yes, because they are more likely to offer higher returns’. This compared to the 11% that said ‘no, because they won’t offer higher returns’.

Hannah Simons, Head of Sustainability Strategy at Schroders, said: “Sustainability does not have to come at the expense of performance, and it is promising to see this manifesting more strongly each year in the data.”

Of course, considering ESG factors is no guarantee of investment performance. Investments will still experience short-term volatility and there is always some risk involved. It’s essential you understand the risk of an asset before investing.

The challenges of ESG investing

Alongside the benefits of ESG investing, there are challenges too. These include:

- Limited funds: The number of ESG funds available is growing but compared to the mainstream market there are limited options. This can make it more difficult to find a fund that suits your needs and goals. If you want your investments to reflect your values, you also need to keep in mind this is subjective and even an ESG fund may not align with your ethics perfectly.

- Additional cost: Researching ESG factors means more time needs to be taken before investing. As a result, ESG investing can mean additional costs. When investing through a fund, you may find management fees are higher.

- Missed opportunities: Avoiding firms that don’t meet your ESG criteria could mean you end up missing out on opportunities. While ESG can create sustainable returns, when you look at it from this perspective, it can harm investment growth in some cases too.

All investments need to consider your goals and situation too. So, alongside ESG factors, make sure you think about your risk profile, investment time frame, and more.

Investing can be complicated, and ESG adds another layer of complexity. If it’s something you’d like to incorporate into your investment portfolio, please get in touch. We’re here to help you understand your investment options and what they could mean for your long-term goals.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Production

Production