On World Mental Health Day, find out how financial wellbeing supports your emotional wellbeing

Posted on2020 has affected us all in a range of different ways. Months of lockdown, solitude, and loss have had an impact on everyone, and looking after our mental health has never been more important than it is right now.

Saturday 10 October 2020 marks World Mental Health Day – a day when the World Health Organisation shines a light on mental health issues and encourages everyone to look after their own mental wellbeing.

As financial advisers, we understand that there is a strong link between financial and mental wellbeing. Taking control of your money can be a positive step on the road to better mental health, and many of our clients identify ‘peace of mind’ as one of the key reasons they come to us for advice.

Now, a major study by insurer Royal London has highlighted the ‘game-changing’ benefits that financial advice can generate when it comes to your mental wellbeing.

Feel better about your money – and yourself

It won’t come as a surprise to you to learn that working with a professional has practical, financial benefits.

Indeed, research carried out by the International Longevity Centre in 2017, and subsequently updated in 2019, has suggested that the value of financial advice could equate to £47,000 in additional wealth over the course of a decade.

What may be less obvious are the mental health benefits of financial advice.

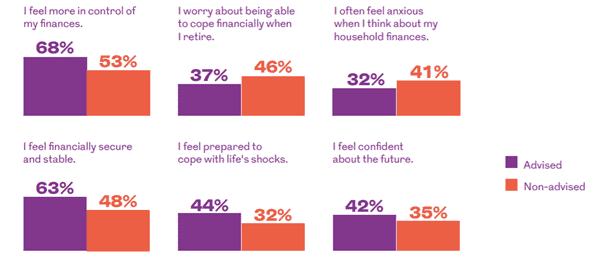

A recent Royal London study confirmed that advice can deliver more than just financial benefits. It also helps to improve your emotional wellbeing by making you feel better about your money – and yourself.

Source: Royal London

The study echoes what our clients tell us about the value of financial advice. The top three emotional benefits of advice are:

- Having access to financial expertise makes me feel more confident in my financial plans

- Receiving professional financial advice helps me feel in control of my finances

- Having contact with a financial adviser gives me peace of mind.

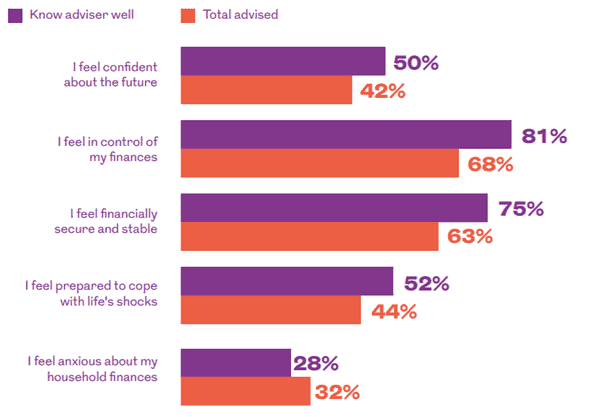

While a one-off meeting with a financial adviser might help you to gain control of your situation or provide clarity in terms of your plans, developing a relationship with an adviser can also add real value.

The chart below shows that, for people who know their adviser well or speak to them on a regular basis, the emotional benefits are even greater – particularly when it comes to feeling in control of their finances.

Source: Royal London

90% of the respondents who receive holistic advice and talk to their adviser regularly have even higher levels of satisfaction than those who have met an adviser once or meet one irregularly.

Good financial health can lead to good mental health

Studies have shown that poor financial health can lead to poor mental health.

Financial stress links to many health issues, and there can be a cyclical connection between mental and financial health – poor mental health can lead to even greater financial difficulties.

So, the conclusion of the report is clear. Getting control over your finances, being prepared to cope with life’s shocks, and feeling financially secure can make you more confident, and improve your overall wellbeing.

If that’s something that would benefit you, use the occasion of World Mental Health Day to make a change.

Get in touch

To find out how we can give you the peace of mind and security that your finances are under control, get in touch. Email enquiries@blackswanfp.co.uk or contact your adviser on 020 3828 8100.

Production

Production